Texas Lady Bird Deed Document

The Texas Lady Bird Deed is a unique estate planning tool that offers a flexible way to transfer property while retaining control during one’s lifetime. This deed allows property owners to convey their real estate to their heirs without the need for probate, simplifying the process of inheritance. One of the standout features of the Lady Bird Deed is that it enables the original owner to maintain the right to use and benefit from the property for as long as they live. This means that the property can be sold, rented, or modified without the heirs' consent, providing a sense of security and autonomy. Additionally, this deed can help avoid potential tax implications that often accompany traditional transfers, making it an attractive option for many families. Understanding the nuances of the Lady Bird Deed is essential for anyone considering estate planning in Texas, as it not only streamlines the transfer process but also ensures that the property remains within the family with minimal complications.

Discover More Lady Bird Deed Forms for Different States

Florida Lady Bird Deed Form - Property owners can retain the right to live in or use the property for their lifetime with this deed.

An Ohio Non-disclosure Agreement form is a legally binding document that individuals or businesses use to protect sensitive information. It serves to ensure that confidential details are not disclosed to unauthorized parties. This form plays a crucial role in various professional and commercial contexts, safeguarding trade secrets, client information, and other critical data. For more information, you can visit All Ohio Forms.

Similar forms

The Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. However, several other documents serve similar purposes in the realm of property transfer and estate planning. Below are five documents that share similarities with the Lady Bird Deed:

- Transfer on Death Deed (TODD): Like the Lady Bird Deed, a Transfer on Death Deed allows property owners to designate beneficiaries who will receive the property upon their death. This document avoids probate, ensuring a smoother transition of ownership.

- Revocable Living Trust: A Revocable Living Trust holds assets during a person's lifetime and allows for the distribution of those assets upon death. Similar to the Lady Bird Deed, it provides control over property while avoiding probate, but it requires more formal management.

- Joint Tenancy with Right of Survivorship: This form of property ownership allows two or more people to hold title to a property together. When one owner passes away, the surviving owner(s) automatically inherit the deceased owner's share, similar to how a Lady Bird Deed transfers property upon death.

- WC-1 Georgia Form: This crucial document, required by the Georgia State Board of Workers’ Compensation, must be completed by employers to report workplace injuries or diseases promptly. For more details, visit https://georgiapdf.com/wc-1-georgia/.

- Life Estate Deed: A Life Estate Deed grants a person the right to live in and use a property for their lifetime, after which the property passes to designated beneficiaries. This is akin to a Lady Bird Deed in that it allows for a retained interest during life while ensuring a smooth transfer after death.

- Will: A Will outlines how a person's assets, including real estate, should be distributed after their death. Although it does not avoid probate like a Lady Bird Deed, it serves a similar purpose in specifying beneficiaries for property transfer.

Each of these documents has its own nuances and benefits, but they all share the goal of facilitating property transfer and ensuring that your wishes are honored after your passing.

Document Example

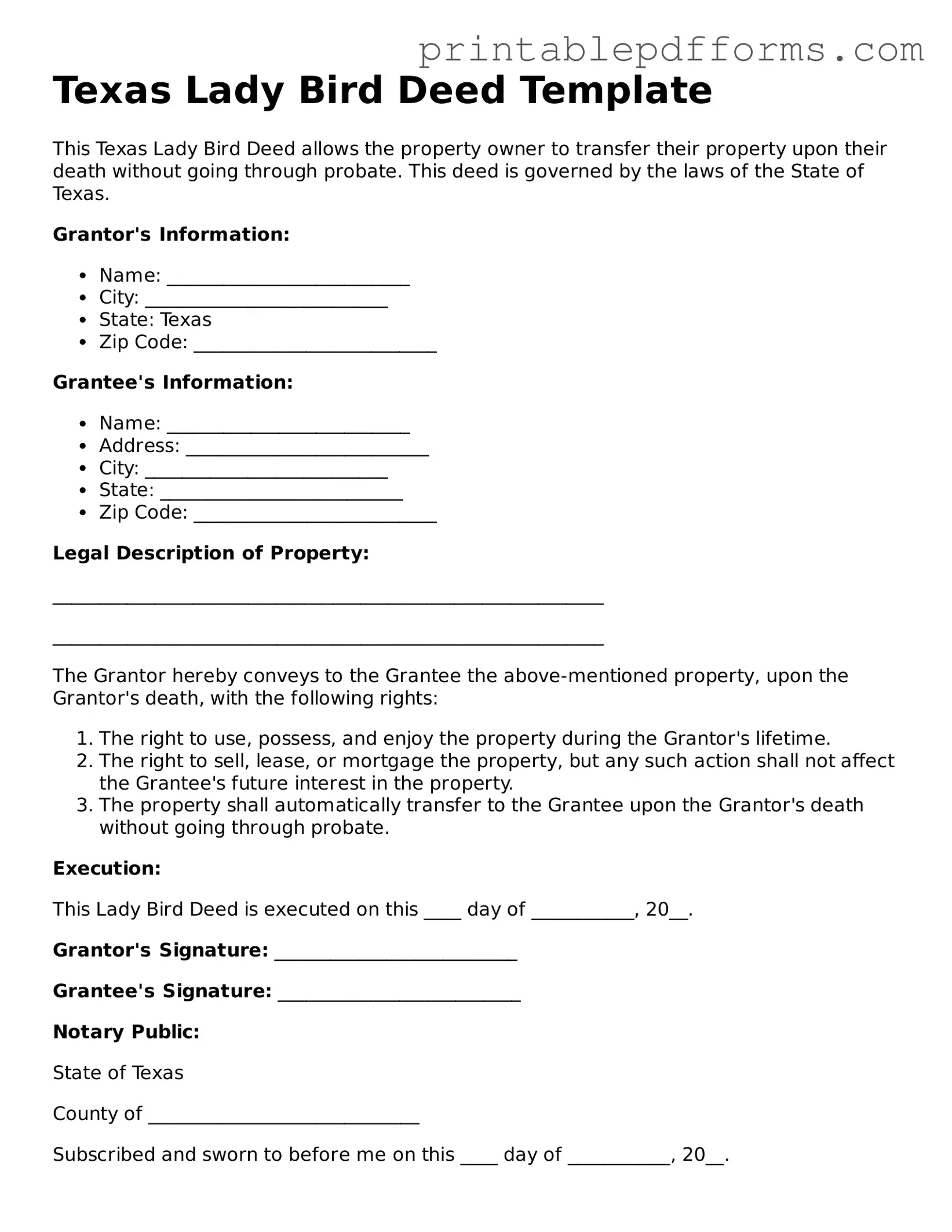

Texas Lady Bird Deed Template

This Texas Lady Bird Deed allows the property owner to transfer their property upon their death without going through probate. This deed is governed by the laws of the State of Texas.

Grantor's Information:

- Name: __________________________

- City: __________________________

- State: Texas

- Zip Code: __________________________

Grantee's Information:

- Name: __________________________

- Address: __________________________

- City: __________________________

- State: __________________________

- Zip Code: __________________________

Legal Description of Property:

___________________________________________________________

___________________________________________________________

The Grantor hereby conveys to the Grantee the above-mentioned property, upon the Grantor's death, with the following rights:

- The right to use, possess, and enjoy the property during the Grantor's lifetime.

- The right to sell, lease, or mortgage the property, but any such action shall not affect the Grantee's future interest in the property.

- The property shall automatically transfer to the Grantee upon the Grantor's death without going through probate.

Execution:

This Lady Bird Deed is executed on this ____ day of ___________, 20__.

Grantor's Signature: __________________________

Grantee's Signature: __________________________

Notary Public:

State of Texas

County of _____________________________

Subscribed and sworn to before me on this ____ day of ___________, 20__.

Notary Public Signature: __________________________

My Commission Expires: __________________________

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | The Texas Lady Bird Deed allows property owners to transfer real estate to beneficiaries while retaining control during their lifetime. |

| Governing Law | The deed is governed by Texas Property Code, Section 255.001. |

| Retained Rights | The property owner retains the right to sell, lease, or mortgage the property without the beneficiaries' consent. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property upon their death. |

| Avoiding Probate | The Lady Bird Deed allows for the transfer of property outside of the probate process. |

| Tax Implications | The property may receive a step-up in basis for tax purposes upon the owner's death, benefiting the beneficiaries. |

| Revocability | The deed can be revoked or amended by the property owner at any time during their lifetime. |

| Execution Requirements | The deed must be executed in writing, signed by the property owner, and notarized. |

| Recording | To be effective, the Lady Bird Deed must be recorded in the county where the property is located. |

| Limitations | The deed cannot be used for transferring homestead property if there are multiple owners unless all agree. |

Crucial Questions on This Form

- Avoids probate: The property passes directly to the beneficiary, bypassing the lengthy probate process.

- Retains control: The owner can continue to manage the property as they see fit.

- Tax benefits: The property may receive a step-up in basis for tax purposes upon the owner's death.

- Flexible: The owner can change the beneficiary or revoke the deed at any time during their lifetime.

- Consult with an attorney to ensure it meets your specific needs.

- Complete the Lady Bird Deed form, including details about the property and beneficiary.

- Sign the deed in front of a notary public.

- File the deed with the county clerk's office where the property is located.

- Limited to Texas: This type of deed is only recognized in Texas, which may not be suitable for individuals with properties in other states.

- Medicaid implications: Transferring property through a Lady Bird Deed may affect Medicaid eligibility for long-term care.

- Not suitable for all situations: Some individuals may have more complex estate planning needs that require different solutions.

What is a Texas Lady Bird Deed?

A Texas Lady Bird Deed is a legal document that allows a property owner to transfer their property to a beneficiary while retaining certain rights. This type of deed enables the owner to maintain control over the property during their lifetime, including the right to sell, mortgage, or change the beneficiary. Upon the owner's death, the property automatically transfers to the named beneficiary without going through probate.

What are the benefits of using a Lady Bird Deed?

There are several advantages to using a Lady Bird Deed:

Who can be named as a beneficiary in a Lady Bird Deed?

A beneficiary can be anyone the property owner chooses, including family members, friends, or even a trust. There are no restrictions on who can be named, but it is advisable to choose someone who will manage the property responsibly.

How does a Lady Bird Deed differ from a traditional deed?

A traditional deed transfers ownership of the property immediately, which means the new owner has full control right away. In contrast, a Lady Bird Deed allows the original owner to retain control during their lifetime while ensuring the property will pass to the beneficiary upon their death. This distinction is crucial for estate planning.

What is the process for creating a Lady Bird Deed?

Creating a Lady Bird Deed involves several steps:

Are there any downsides to a Lady Bird Deed?

While Lady Bird Deeds offer many benefits, there are potential downsides to consider:

Can a Lady Bird Deed be revoked or changed?

Yes, a Lady Bird Deed can be revoked or modified at any time during the property owner's lifetime. The owner must execute a new deed or a revocation document, which should also be filed with the county clerk's office to ensure it is legally recognized.

Is legal assistance necessary when creating a Lady Bird Deed?

While it is possible to create a Lady Bird Deed without legal assistance, it is highly recommended to consult with an attorney. An attorney can ensure that the deed is properly drafted, executed, and filed, minimizing the risk of legal issues in the future.

Documents used along the form

The Texas Lady Bird Deed is a useful tool for property owners who wish to transfer their property while retaining certain rights. However, several other forms and documents may accompany this deed to ensure a smooth and legally compliant transfer. Below is a list of these documents, each serving a specific purpose in the process.

- Warranty Deed: This document guarantees that the grantor holds clear title to the property and has the right to transfer it. It provides assurance to the grantee that there are no undisclosed claims against the property.

- Quitclaim Deed: This form transfers any interest the grantor may have in the property without making any promises about the title's status. It is often used in situations where the parties know each other well, such as between family members.

- Power of Attorney: This legal document allows one person to act on behalf of another in legal matters, including property transactions. It can be crucial if the property owner is unable to sign the Lady Bird Deed personally.

- Affidavit of Heirship: This document helps establish the heirs of a deceased property owner. It can be useful in clarifying ownership and ensuring a smooth transfer of property after death.

- Title Insurance Policy: This insurance protects against losses arising from disputes over property ownership. It is often recommended to secure title insurance when transferring property to mitigate risks.

- Property Tax Exemption Application: If the property qualifies for certain tax exemptions, this application must be submitted to the appropriate local authorities. It ensures that the property owner receives any applicable tax benefits.

- Tractor Bill of Sale Form: If you are purchasing agricultural equipment, it’s imperative to use the comprehensive Tractor Bill of Sale template to document the transaction and protect both parties' interests.

- Notice of Transfer: This document informs local tax authorities and other relevant parties of the property transfer. It is important for updating records and ensuring proper tax assessments.

- Estate Planning Documents: These may include wills or trusts that outline how a person's assets, including property, should be managed and distributed after their death. They can work in conjunction with a Lady Bird Deed to achieve specific estate planning goals.

Understanding these additional forms and documents can help ensure that the property transfer process is efficient and legally sound. Each document plays a vital role in protecting the interests of all parties involved and facilitating a smooth transition of ownership.

Misconceptions

Understanding the Texas Lady Bird Deed can be challenging, and misconceptions often arise. Here are seven common misunderstandings about this unique legal instrument:

-

It only applies to real estate.

Many believe that the Lady Bird Deed is limited to real estate, but it can also encompass other types of property. This includes personal property, which can be transferred through this deed.

-

It eliminates the need for a will.

Some think that using a Lady Bird Deed negates the necessity for a will. While it does facilitate the transfer of property outside of probate, a will is still essential for addressing other assets and final wishes.

-

It automatically transfers ownership upon death.

There’s a misconception that ownership transfers instantly upon death. In reality, the deed allows for a smooth transition of property, but it must be recorded properly to ensure that the transfer is recognized.

-

It is only beneficial for elderly individuals.

While the Lady Bird Deed is often associated with estate planning for seniors, it can be advantageous for anyone looking to manage property transfer efficiently. Younger individuals can also use it to avoid probate complications.

-

It protects against all creditors.

Some people mistakenly believe that a Lady Bird Deed shields property from all creditors. However, while it can help protect the property from certain claims, it does not offer absolute immunity from all debts.

-

It requires court approval.

Another common myth is that the Lady Bird Deed needs court approval to be effective. This is not true; it is a straightforward document that, once executed and recorded, functions without the need for judicial oversight.

-

It is a complicated process.

Many individuals fear that creating a Lady Bird Deed is overly complex. In reality, while it is important to understand the implications, the process itself can be relatively simple with proper guidance.

By dispelling these misconceptions, individuals can make more informed decisions about utilizing the Texas Lady Bird Deed in their estate planning efforts.