Texas Last Will and Testament Document

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. In Texas, the Last Will and Testament form serves as a legal document that outlines how your assets will be distributed and who will be responsible for carrying out your wishes. This form allows you to designate beneficiaries for your property, appoint an executor to manage your estate, and even name guardians for your minor children. It is important to understand the requirements for a valid will in Texas, which include being at least 18 years old, of sound mind, and signing the document in the presence of witnesses. Additionally, the Texas Last Will and Testament form can be tailored to reflect your unique circumstances, whether you have complex assets or simple wishes. By taking the time to complete this form, you can provide clarity and peace of mind for your loved ones during a difficult time.

Discover More Last Will and Testament Forms for Different States

Can I Create My Own Will - Permits an individual to leave their legacy in a meaningful way.

For anyone considering their healthcare options, it is important to understand the significance of a living will in detailing your preferences. Utilizing a formal living will document can help ensure your medical wishes are honored, even when you are unable to communicate them effectively.

Florida Will Pdf Free - A means of appointing an executor to oversee the distribution of one’s estate.

How to Create a Will in Pa - Must be signed and dated by the testator for validity.

Similar forms

- Living Will: A living will outlines a person's preferences for medical treatment in situations where they are unable to communicate their wishes. Like a Last Will and Testament, it reflects the individual's intentions, but it focuses specifically on healthcare decisions rather than the distribution of assets after death.

-

Release of Liability: This crucial form offers a way for individuals to acknowledge the risks involved in certain activities and waive their rights to pursue legal actions in case of injuries or damages. For more information on how to safeguard yourself, consider completing a Liability Waiver.

- Trust Document: A trust document establishes a legal arrangement where one party holds property for the benefit of another. Similar to a Last Will and Testament, it allows for the management and distribution of assets, but it can take effect during the grantor's lifetime and often avoids probate.

- Power of Attorney: A power of attorney grants someone the authority to act on another's behalf in legal or financial matters. This document is similar to a Last Will and Testament in that it designates an individual to make decisions, but it is effective while the person is still alive, unlike a will.

- Health Care Proxy: A health care proxy allows an individual to appoint someone to make medical decisions on their behalf if they become incapacitated. This document parallels a Last Will and Testament in that both express personal wishes regarding important decisions, but the health care proxy focuses solely on medical care.

- Letter of Instruction: A letter of instruction provides guidance to loved ones about personal wishes and practical matters after death. While a Last Will and Testament is a legal document for asset distribution, a letter of instruction serves as a non-legal supplement, offering insights and information not covered in the will.

- Codicil: A codicil is an amendment to an existing will that allows individuals to make changes without drafting a new will. It is similar to a Last Will and Testament in that it deals with the distribution of assets, but it serves as a means to update or clarify the original will's provisions.

Document Example

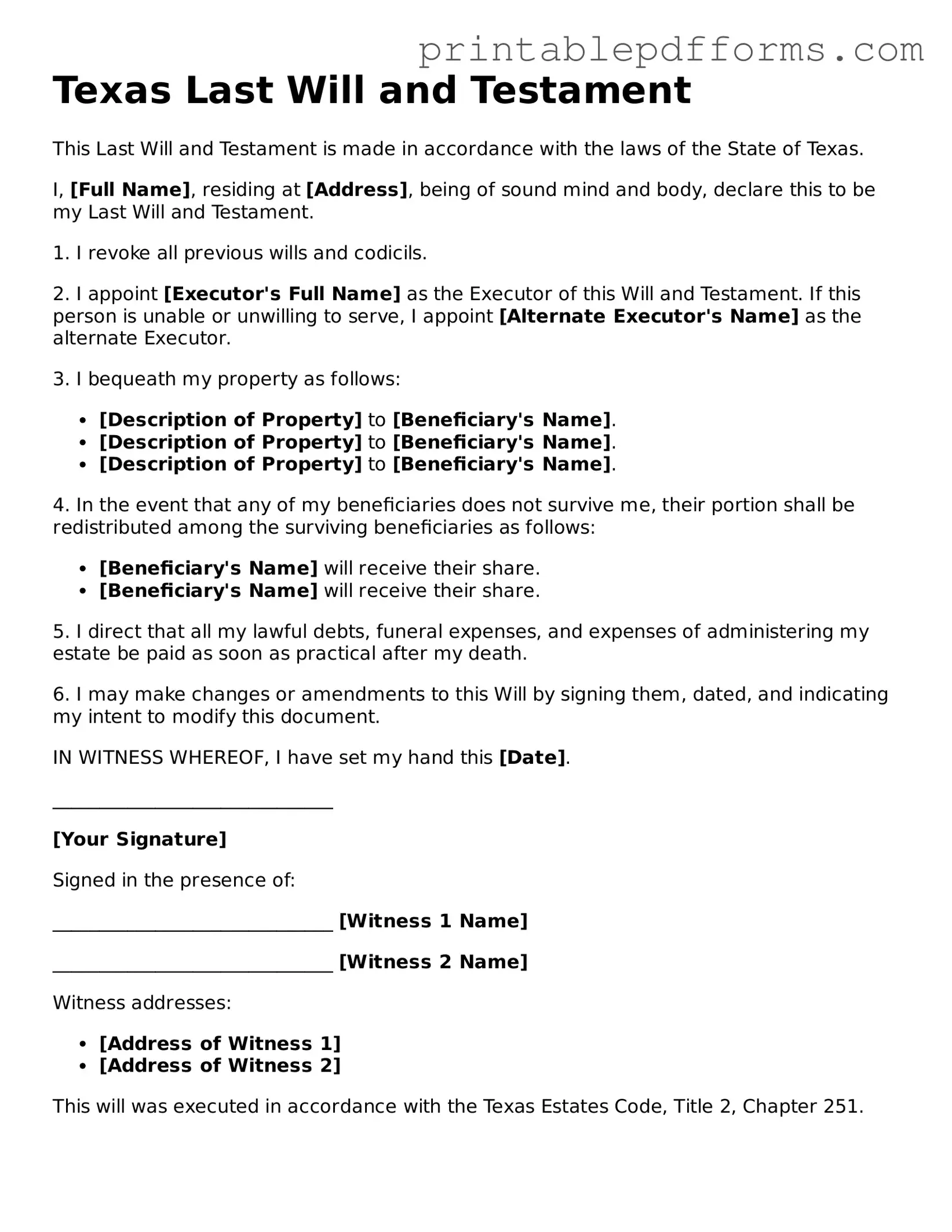

Texas Last Will and Testament

This Last Will and Testament is made in accordance with the laws of the State of Texas.

I, [Full Name], residing at [Address], being of sound mind and body, declare this to be my Last Will and Testament.

1. I revoke all previous wills and codicils.

2. I appoint [Executor's Full Name] as the Executor of this Will and Testament. If this person is unable or unwilling to serve, I appoint [Alternate Executor's Name] as the alternate Executor.

3. I bequeath my property as follows:

- [Description of Property] to [Beneficiary's Name].

- [Description of Property] to [Beneficiary's Name].

- [Description of Property] to [Beneficiary's Name].

4. In the event that any of my beneficiaries does not survive me, their portion shall be redistributed among the surviving beneficiaries as follows:

- [Beneficiary's Name] will receive their share.

- [Beneficiary's Name] will receive their share.

5. I direct that all my lawful debts, funeral expenses, and expenses of administering my estate be paid as soon as practical after my death.

6. I may make changes or amendments to this Will by signing them, dated, and indicating my intent to modify this document.

IN WITNESS WHEREOF, I have set my hand this [Date].

______________________________

[Your Signature]

Signed in the presence of:

______________________________ [Witness 1 Name]

______________________________ [Witness 2 Name]

Witness addresses:

- [Address of Witness 1]

- [Address of Witness 2]

This will was executed in accordance with the Texas Estates Code, Title 2, Chapter 251.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Legal Requirement | A Last Will and Testament in Texas must be in writing and signed by the testator, who is at least 18 years old and of sound mind. |

| Witnesses | Texas law requires that the will be witnessed by at least two individuals who are at least 14 years old. These witnesses cannot be beneficiaries of the will. |

| Self-Proving Affidavit | Including a self-proving affidavit allows the will to be validated without the need for witnesses to testify in court, streamlining the probate process. |

| Governing Law | The Texas Estates Code governs the creation and execution of Last Wills and Testaments in Texas. |

Crucial Questions on This Form

What is a Last Will and Testament in Texas?

A Last Will and Testament is a legal document that outlines how a person's assets and property should be distributed after their death. In Texas, this document allows individuals to express their wishes regarding guardianship of minor children, the distribution of their estate, and the appointment of an executor to manage their affairs. Having a will can provide peace of mind, knowing that your wishes will be honored.

Who can create a Last Will and Testament in Texas?

In Texas, any person who is at least 18 years old and of sound mind can create a Last Will and Testament. This means that you should be able to understand the nature of your actions and the consequences of creating a will. Additionally, you must not be under duress or undue influence when making your decisions.

What are the requirements for a valid will in Texas?

For a will to be considered valid in Texas, it must meet certain criteria:

- The will must be in writing.

- The person creating the will (the testator) must sign it.

- The will must be witnessed by at least two individuals who are at least 14 years old and not beneficiaries of the will.

Alternatively, a handwritten will (holographic will) can be valid if it is signed by the testator and the material provisions are in their handwriting.

Can I change or revoke my will in Texas?

Yes, you can change or revoke your will at any time as long as you are of sound mind. To make changes, you can create a new will or add a codicil, which is a document that modifies the existing will. If you want to revoke a will entirely, you can do so by destroying it or by creating a new will that explicitly states that the previous will is revoked.

What happens if I die without a will in Texas?

If you pass away without a will, your estate will be distributed according to Texas intestacy laws. This means that the state will determine how your assets are divided, which may not align with your wishes. Typically, your assets will go to your closest relatives, such as your spouse, children, or parents. Having a will helps ensure that your preferences are followed.

How do I ensure my will is properly executed?

To ensure your will is properly executed, follow these steps:

- Make sure it is signed by you and witnessed by at least two individuals.

- Store the original document in a safe place, such as a safe deposit box or with your attorney.

- Inform your loved ones about the location of your will.

Consulting with an attorney can also help you navigate the requirements and ensure that your will is valid.

Can I include specific wishes for my funeral in my will?

While you can include your wishes for your funeral in your will, it is important to note that these wishes may not be legally binding. Funeral arrangements are typically handled by your family or executor. To ensure your wishes are followed, consider discussing them with your loved ones and possibly creating a separate document specifically for funeral instructions.

Documents used along the form

When preparing a Texas Last Will and Testament, individuals often consider several other important documents that can complement their estate planning efforts. Each of these documents serves a unique purpose and helps ensure that a person's wishes are honored after their passing. Below is a list of five commonly used forms and documents that work in conjunction with a will.

- Durable Power of Attorney: This document allows an individual to appoint someone else to make financial and legal decisions on their behalf if they become incapacitated. It remains effective even if the person who created it loses the ability to make decisions.

- Medical Power of Attorney: This form enables a person to designate a trusted individual to make healthcare decisions for them in the event they are unable to communicate their wishes. It ensures that medical preferences are respected during critical times.

- Prenuptial Agreement: This legal document offers couples in Ohio a way to delineate the division of assets and debts prior to marriage, ensuring clarity on financial matters. For more information, visit All Ohio Forms.

- Living Will: A living will outlines a person's preferences regarding medical treatment in situations where they may be terminally ill or permanently unconscious. It serves as a guide for healthcare providers and loved ones about the individual's desires concerning life-sustaining measures.

- Beneficiary Designations: Certain assets, such as life insurance policies and retirement accounts, allow individuals to designate beneficiaries directly. These designations can supersede a will and should be reviewed regularly to ensure they align with one's overall estate plan.

- Trust Documents: Establishing a trust can help manage and distribute assets according to specific instructions. Trusts can provide benefits such as avoiding probate, protecting assets from creditors, and ensuring privacy regarding the distribution of one's estate.

Incorporating these documents into an estate plan can provide clarity and peace of mind. Each form plays a vital role in ensuring that personal wishes are respected and that loved ones are taken care of, both in life and after death.

Misconceptions

Understanding the Texas Last Will and Testament form is crucial for effective estate planning. However, several misconceptions can lead to confusion. Here are ten common misconceptions:

- Only wealthy individuals need a will. Many people believe that a will is only necessary for those with significant assets. In reality, anyone with personal belongings, children, or specific wishes for their estate should consider having a will.

- A will can be verbal. Some think that a verbal agreement or understanding is sufficient. In Texas, a will must be in writing to be legally valid.

- All wills must be notarized. While notarization can add an extra layer of validity, it is not a requirement in Texas. A will can be valid without a notary if it is properly signed and witnessed.

- Once a will is created, it cannot be changed. This is a common myth. Wills can be updated or revoked at any time, as long as the person is of sound mind and follows the legal requirements.

- Only a lawyer can create a will. Although legal assistance can be beneficial, individuals can create a valid will on their own using templates or forms, as long as they adhere to Texas laws.

- Wills are only for after death. Some people think wills only matter after someone passes away. In fact, having a will can help clarify wishes and reduce disputes among family members while the individual is still alive.

- All debts must be paid before any distribution of assets. While debts do need to be settled, Texas allows certain exemptions and priorities in how assets are distributed, which may affect the timing of payments.

- A handwritten will is not valid. In Texas, a handwritten will, known as a holographic will, can be valid if it is signed and the material provisions are in the testator's handwriting.

- Beneficiaries must be family members. Many believe only relatives can be named as beneficiaries. In Texas, individuals can choose anyone, including friends or organizations, as beneficiaries.

- Having a will avoids probate. While a will can simplify the probate process, it does not eliminate it. Most wills must still go through probate to be validated and executed.

Being aware of these misconceptions can help individuals navigate the estate planning process more effectively and ensure their wishes are honored.