Texas Loan Agreement Document

In Texas, a Loan Agreement form serves as a vital document for individuals and businesses seeking to formalize a lending arrangement. This form outlines the essential terms and conditions of the loan, including the amount borrowed, interest rates, and repayment schedules. It is crucial for both lenders and borrowers to understand their rights and obligations as stipulated in the agreement. The document typically includes sections on collateral, default provisions, and any fees associated with the loan. By clearly delineating the responsibilities of each party, the Loan Agreement helps to prevent misunderstandings and disputes down the line. Additionally, it often requires signatures from both parties, ensuring that all involved acknowledge and accept the terms laid out. Understanding the components of this form is key to navigating the lending process in Texas effectively.

Discover More Loan Agreement Forms for Different States

Promissory Note New York - Specifies the impact of bankruptcy on the loan agreement.

Before starting a business in New York, it's vital to understand the requirements associated with the New York Articles of Incorporation form. This legal document not only establishes your corporation but also provides essential details such as its name, purpose, and structure. For a comprehensive guide on filling out this important form, you can visit https://nypdfforms.com/articles-of-incorporation-form.

Free Promissory Note Template Florida - Notes any restrictions on the borrower's ability to take out further loans.

Similar forms

Promissory Note: Like a Loan Agreement, a promissory note outlines the borrower's promise to repay the loan. However, it is usually simpler and focuses primarily on the borrower's commitment rather than the terms of the loan.

- Workers' Compensation Claim Form: Similar to other agreements, this essential document allows employers to report workplace injuries quickly. Filing the https://georgiapdf.com/wc-1-georgia form is crucial to ensure compliance with state regulations and avoid penalties.

Mortgage Agreement: This document secures a loan with real property. Similar to a Loan Agreement, it details the terms of the loan, but it also specifies the consequences of default, particularly concerning the property.

Security Agreement: This document is used when a borrower offers collateral to secure a loan. It shares similarities with a Loan Agreement in that it details the terms and obligations of both parties.

Lease Agreement: A lease outlines the terms under which one party rents property from another. While it serves a different purpose, both documents establish terms, responsibilities, and timelines for payment.

Credit Agreement: This document governs the terms of a credit facility. It is similar to a Loan Agreement as it outlines the borrowing terms, repayment schedule, and interest rates.

Personal Loan Agreement: This is a specific type of Loan Agreement for personal loans. It includes similar terms but is often less formal and may not require collateral.

Partnership Agreement: While primarily for business relationships, this document can include financial arrangements similar to those found in Loan Agreements, detailing how funds are shared or repaid among partners.

Forbearance Agreement: This document allows a borrower to temporarily postpone payments. It is similar to a Loan Agreement in that it modifies the terms of repayment but focuses on providing relief during financial hardship.

Debt Settlement Agreement: This document outlines terms for settling a debt for less than the full amount owed. While it serves a different purpose, it shares the need for clear terms and mutual agreement.

Guaranty Agreement: This document involves a third party agreeing to pay the loan if the borrower defaults. It complements a Loan Agreement by adding another layer of security for the lender.

Document Example

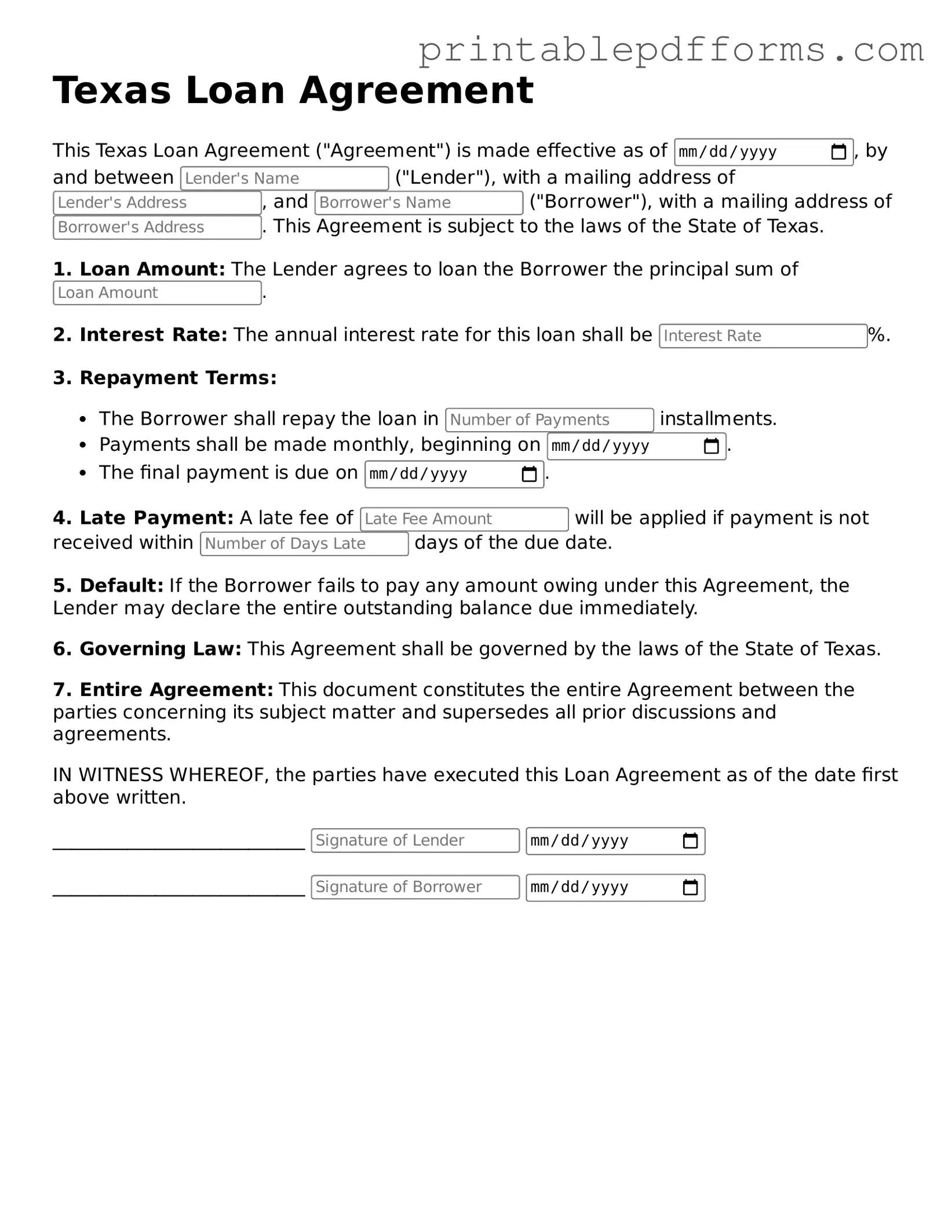

Texas Loan Agreement

This Texas Loan Agreement ("Agreement") is made effective as of , by and between ("Lender"), with a mailing address of , and ("Borrower"), with a mailing address of . This Agreement is subject to the laws of the State of Texas.

1. Loan Amount: The Lender agrees to loan the Borrower the principal sum of .

2. Interest Rate: The annual interest rate for this loan shall be %.

3. Repayment Terms:

- The Borrower shall repay the loan in installments.

- Payments shall be made monthly, beginning on .

- The final payment is due on .

4. Late Payment: A late fee of will be applied if payment is not received within days of the due date.

5. Default: If the Borrower fails to pay any amount owing under this Agreement, the Lender may declare the entire outstanding balance due immediately.

6. Governing Law: This Agreement shall be governed by the laws of the State of Texas.

7. Entire Agreement: This document constitutes the entire Agreement between the parties concerning its subject matter and supersedes all prior discussions and agreements.

IN WITNESS WHEREOF, the parties have executed this Loan Agreement as of the date first above written.

___________________________

___________________________

PDF Form Specs

| Fact Name | Detail |

|---|---|

| Governing Law | The Texas Loan Agreement is governed by Texas state law. |

| Purpose | This form is used to outline the terms of a loan between a lender and a borrower. |

| Parties Involved | The agreement typically involves a lender and a borrower. |

| Loan Amount | The specific amount of money being borrowed is clearly stated in the agreement. |

| Interest Rate | The form includes the interest rate that will be applied to the loan. |

| Repayment Terms | It outlines how and when the borrower will repay the loan. |

| Default Consequences | The agreement specifies what happens if the borrower fails to repay the loan. |

Crucial Questions on This Form

What is a Texas Loan Agreement form?

A Texas Loan Agreement form is a legal document that outlines the terms and conditions under which a loan is made in the state of Texas. This agreement serves as a contract between the lender and the borrower, detailing important aspects such as the loan amount, interest rate, repayment schedule, and any collateral involved. It is crucial for both parties to understand their rights and obligations under this agreement to avoid potential disputes in the future.

What are the key components of a Texas Loan Agreement?

Several essential elements should be included in a Texas Loan Agreement to ensure clarity and enforceability. These components typically include:

- Loan Amount: The total sum of money being borrowed.

- Interest Rate: The percentage charged on the loan amount, which can be fixed or variable.

- Repayment Terms: Details regarding how and when the borrower will repay the loan, including the frequency of payments.

- Collateral: Any assets pledged by the borrower to secure the loan, which the lender can claim if the borrower defaults.

- Default Clauses: Conditions under which the lender can declare the borrower in default and the consequences that follow.

Is it necessary to have a lawyer review the Texas Loan Agreement?

While it is not legally required to have a lawyer review a Texas Loan Agreement, doing so is highly recommended. A legal professional can help ensure that the agreement complies with Texas laws and that it protects the interests of both parties. They can also clarify any complex terms and conditions, making sure that all parties fully understand their rights and obligations. This proactive step can prevent misunderstandings and potential legal issues down the line.

What happens if the borrower defaults on the loan?

If the borrower defaults on the loan, the lender has several options available to them, as outlined in the Loan Agreement. Common consequences of default may include:

- The lender may demand immediate repayment of the entire loan balance.

- The lender can initiate legal proceedings to recover the owed amount.

- If collateral is involved, the lender has the right to seize the collateral to satisfy the debt.

- The borrower’s credit score may be negatively impacted, making it harder to secure future loans.

It is essential for borrowers to communicate with their lenders if they anticipate difficulties in making payments, as lenders may be willing to negotiate alternative arrangements.

Documents used along the form

When entering into a loan agreement in Texas, there are several additional forms and documents that can accompany the main loan agreement. Each of these documents serves a specific purpose and helps to clarify the terms and conditions of the loan. Below is a list of five commonly used documents that you may encounter alongside a Texas Loan Agreement.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments. The promissory note acts as a legal confirmation of the borrower's obligation.

- Security Agreement: If the loan is secured by collateral, a security agreement is used to detail what assets are being pledged. This document provides the lender with rights to the collateral in case the borrower defaults on the loan.

- Notary Acknowledgement: This form is essential when notarizing loan agreements, as it certifies that the signer's signature was given willingly. It serves to prevent fraud and can be critical in legal disputes, making it an important addition to the loan documentation. For further details, refer to All Ohio Forms.

- Disclosure Statement: This statement provides important information about the loan, including fees, interest rates, and other terms. It ensures that the borrower fully understands the financial implications of the agreement before signing.

- Loan Application: Before a loan is approved, borrowers typically fill out a loan application. This document collects information about the borrower’s financial status, employment, and credit history, helping the lender assess the risk of lending.

- Amortization Schedule: This schedule outlines the repayment plan for the loan, breaking down each payment into principal and interest components over time. It helps borrowers understand how their payments will affect the total loan balance.

Understanding these documents can significantly enhance your experience with the loan process. Each one plays a crucial role in ensuring clarity and protection for both the borrower and the lender. Being informed about these forms will help you navigate the complexities of borrowing in Texas more effectively.

Misconceptions

Understanding the Texas Loan Agreement form is crucial for anyone involved in lending or borrowing. However, several misconceptions can lead to confusion. Here are nine common misconceptions about this form:

- All loan agreements are the same. Each loan agreement can vary significantly based on the terms, interest rates, and specific conditions set by the lender and borrower.

- Only banks can use the Texas Loan Agreement form. This form is available for use by any individual or business, not just financial institutions.

- The form is only for large loans. The Texas Loan Agreement can be used for loans of any size, whether small personal loans or larger business loans.

- Signing the form means the loan is guaranteed. Signing the agreement does not guarantee approval; it simply indicates acceptance of the terms.

- Verbal agreements are sufficient. A written loan agreement is essential for legal protection and clarity. Verbal agreements can lead to misunderstandings.

- Once signed, the terms cannot be changed. The terms can be renegotiated if both parties agree, but any changes must be documented in writing.

- The borrower is always at a disadvantage. The agreement is designed to protect both parties. Borrowers have rights and protections outlined in the document.

- Interest rates are fixed and cannot be negotiated. Interest rates can often be negotiated based on the borrower’s creditworthiness and other factors.

- Legal advice is unnecessary. It is advisable to seek legal counsel when drafting or signing a loan agreement to ensure all terms are clear and enforceable.

By addressing these misconceptions, individuals can approach the Texas Loan Agreement with a clearer understanding and make informed decisions.