Texas Motor Vehicle Bill of Sale Document

When buying or selling a vehicle in Texas, completing a Motor Vehicle Bill of Sale form is an essential step in the transaction process. This document serves as a written record of the sale, detailing key information about the vehicle, including its make, model, year, and Vehicle Identification Number (VIN). Additionally, the form captures the names and addresses of both the buyer and the seller, ensuring that both parties are clearly identified. It also outlines the sale price, which can be crucial for tax purposes. The Bill of Sale may include terms regarding the condition of the vehicle, any warranties, and the date of the sale, providing a comprehensive overview of the transaction. By properly filling out this form, both parties can protect their interests and establish a clear understanding of the terms of the sale, making it a vital component of any vehicle transfer in the Lone Star State.

Discover More Motor Vehicle Bill of Sale Forms for Different States

What Does Bill of Sale Look Like - This document is often required by state law when a vehicle changes hands.

Copy of a Bill of Sale for a Vehicle - The Motor Vehicle Bill of Sale is a crucial document in transferring ownership of a vehicle from one party to another.

When engaging in the sale or purchase of a trailer in California, it is essential to utilize the appropriate documentation. The Bill of Sale for a Trailer serves as a legal record of the transfer and includes vital information that protects both the buyer and seller during the transaction process.

Bill of Sale Florida Example - The form can be customized to meet the requirements of the specific sale.

Mso Dmv - Having a complete Bill of Sale can assist with potential registration issues later on.

Similar forms

- Real Estate Bill of Sale: Similar to the Motor Vehicle Bill of Sale, this document transfers ownership of real property. Both documents serve as proof of the transaction and include details about the buyer, seller, and the item being sold.

- Boat Bill of Sale: This form is used for the sale of boats and watercraft. Like the Motor Vehicle Bill of Sale, it outlines the terms of sale, identifies the parties involved, and provides a record of the transaction.

- Equipment Bill of Sale: This document is used for the sale of heavy machinery or equipment. It shares similarities with the Motor Vehicle Bill of Sale in that it details the condition of the item and includes warranty information.

- Motorcycle Bill of Sale: This form is specifically for the sale of motorcycles. It contains comparable information to the Motor Vehicle Bill of Sale, such as vehicle identification numbers and purchase prices.

- Mobile Home Bill of Sale: Used for the sale of mobile homes, this document functions similarly by transferring ownership and providing essential details about the transaction and the parties involved.

- Boat Bill of Sale form: A Boat Bill of Sale form is essential for transferring ownership of a boat, serving as proof of sale and documenting critical details about the transaction.

- Personal Property Bill of Sale: This document covers the sale of various personal items, including furniture and electronics. Like the Motor Vehicle Bill of Sale, it serves as a legal record of the sale and protects both buyer and seller.

Document Example

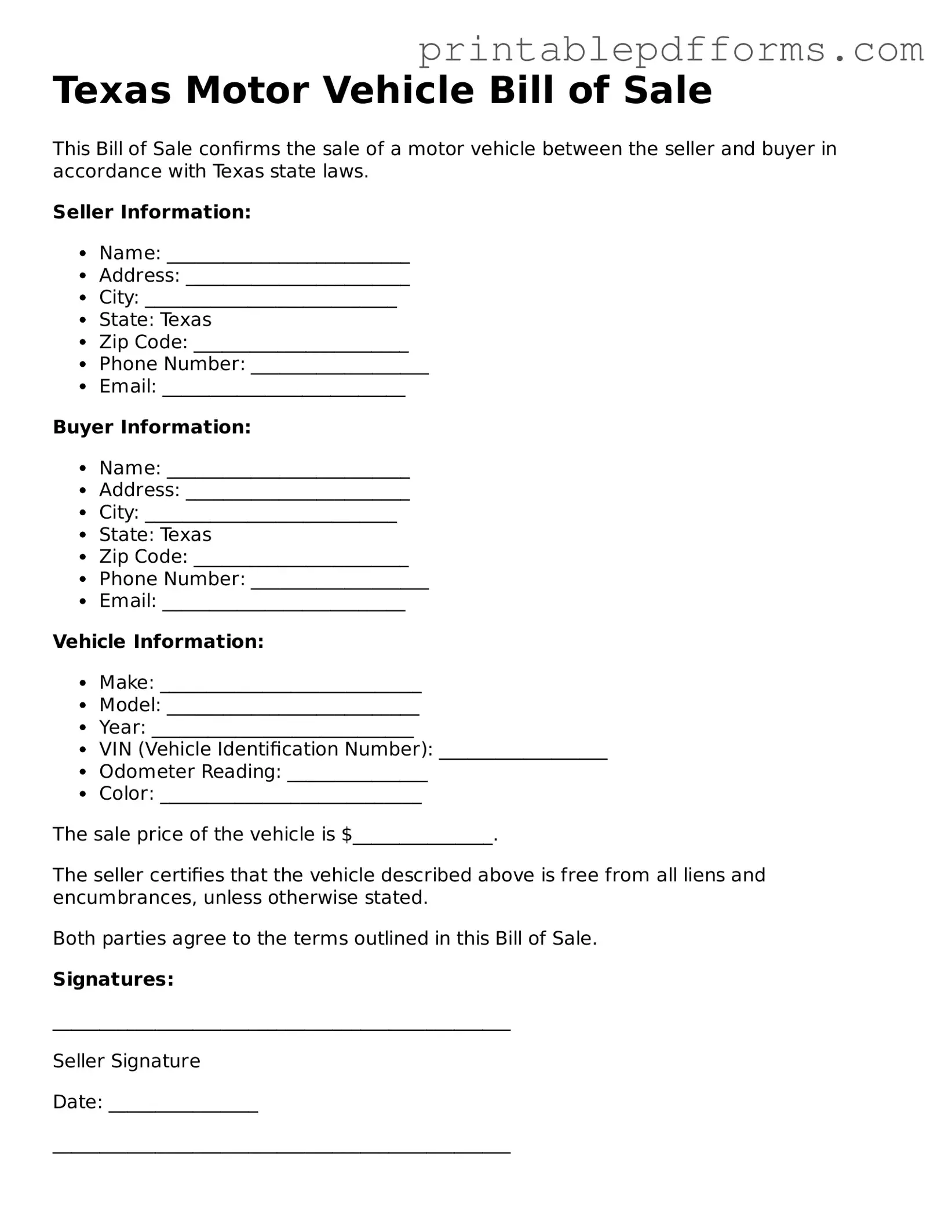

Texas Motor Vehicle Bill of Sale

This Bill of Sale confirms the sale of a motor vehicle between the seller and buyer in accordance with Texas state laws.

Seller Information:

- Name: __________________________

- Address: ________________________

- City: ___________________________

- State: Texas

- Zip Code: _______________________

- Phone Number: ___________________

- Email: __________________________

Buyer Information:

- Name: __________________________

- Address: ________________________

- City: ___________________________

- State: Texas

- Zip Code: _______________________

- Phone Number: ___________________

- Email: __________________________

Vehicle Information:

- Make: ____________________________

- Model: ___________________________

- Year: ____________________________

- VIN (Vehicle Identification Number): __________________

- Odometer Reading: _______________

- Color: ____________________________

The sale price of the vehicle is $_______________.

The seller certifies that the vehicle described above is free from all liens and encumbrances, unless otherwise stated.

Both parties agree to the terms outlined in this Bill of Sale.

Signatures:

_________________________________________________

Seller Signature

Date: ________________

_________________________________________________

Buyer Signature

Date: ________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Texas Motor Vehicle Bill of Sale form serves as a legal document to record the sale and transfer of ownership of a motor vehicle in Texas. |

| Governing Law | This form is governed by the Texas Transportation Code, specifically Title 7, Subtitle A, Chapter 501. |

| Required Information | Essential details include the buyer's and seller's names, addresses, vehicle identification number (VIN), and sale price. |

| Notarization | While notarization is not mandatory, having the document notarized can provide additional legal protection for both parties. |

| Usage | The form is commonly used for private sales between individuals, but can also be used by dealerships. |

| Record Keeping | It is advisable for both the buyer and seller to keep a copy of the completed Bill of Sale for their records. |

Crucial Questions on This Form

What is a Texas Motor Vehicle Bill of Sale?

A Texas Motor Vehicle Bill of Sale is a legal document that serves as a record of the sale of a vehicle. It includes important information about the buyer, seller, and the vehicle being sold. This document is crucial for transferring ownership and can be used for registration purposes with the Texas Department of Motor Vehicles.

Is a Bill of Sale required in Texas?

While a Bill of Sale is not legally required for every vehicle sale in Texas, it is highly recommended. Having this document protects both the buyer and the seller by providing proof of the transaction. It can also help resolve any disputes that may arise after the sale.

What information should be included in the Bill of Sale?

A comprehensive Bill of Sale should include the following information:

- The names and addresses of both the buyer and the seller.

- The vehicle identification number (VIN).

- The make, model, and year of the vehicle.

- The sale price of the vehicle.

- The date of the sale.

- Any disclosures regarding the vehicle's condition, if applicable.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale in Texas. However, it is important to ensure that all required information is included and that the document is clear and concise. Many templates are available online, or you may choose to draft your own document. Just make sure it meets all legal requirements.

Do I need to have the Bill of Sale notarized?

In Texas, notarization is not required for a Bill of Sale. However, having the document notarized can add an extra layer of protection and authenticity. It may also be beneficial if you need to present the document for any legal or administrative purposes.

What if the vehicle has a lien?

If the vehicle has an outstanding lien, it is important to address this before completing the sale. The seller should provide the buyer with information about the lien, and it may be necessary to pay off the lien before the sale can be finalized. The Bill of Sale should also indicate whether the lien has been satisfied.

How do I use the Bill of Sale for vehicle registration?

After completing the sale, the buyer can use the Bill of Sale to register the vehicle with the Texas Department of Motor Vehicles. The buyer will need to present the Bill of Sale along with other required documents, such as proof of insurance and a completed application for title. This process ensures that the vehicle's title is transferred into the buyer's name.

What happens if I lose the Bill of Sale?

If you lose the Bill of Sale, it can complicate matters, particularly if you need to prove ownership or if a dispute arises. It is advisable to keep a copy of the Bill of Sale in a safe place. If you cannot locate it, you may need to contact the seller to obtain another copy or consider other legal avenues to establish ownership.

Can I use a Bill of Sale for a vehicle purchased out of state?

Yes, a Bill of Sale can be used for vehicles purchased out of state. However, it is important to familiarize yourself with the specific requirements of the state where the vehicle was purchased, as they may differ from Texas regulations. Ensure that all necessary information is included to facilitate a smooth registration process in Texas.

What if the vehicle is a gift?

If the vehicle is being given as a gift, a Bill of Sale can still be beneficial. It should clearly state that the vehicle is a gift and include any necessary details about the transaction. This documentation helps to clarify the transfer of ownership and may be required for registration purposes.

Documents used along the form

When buying or selling a vehicle in Texas, the Motor Vehicle Bill of Sale is an important document. However, several other forms and documents are often needed to ensure a smooth transaction. Here are five commonly used documents that complement the Bill of Sale.

- Title Transfer Application: This form is required to transfer ownership of the vehicle from the seller to the buyer. It must be completed and submitted to the Texas Department of Motor Vehicles (TxDMV) along with the title.

- Alabama Bill of Sale Form: To facilitate a proper transfer of ownership, refer to the comprehensive Alabama bill of sale form instructions for ensuring your transaction meets all legal requirements.

- Vehicle Title: The vehicle title serves as proof of ownership. The seller must sign the title over to the buyer, and the buyer needs to ensure the title is in their name after the sale.

- Odometer Disclosure Statement: This document records the vehicle's mileage at the time of sale. It is crucial for preventing odometer fraud and is often included in the title transfer process.

- Application for Texas Title and/or Registration: Buyers must complete this application to register the vehicle in their name. It includes details about the vehicle and the new owner.

- Proof of Insurance: Before registering the vehicle, buyers must provide proof of insurance. This document shows that the vehicle is covered and meets Texas insurance requirements.

Having these documents ready can help streamline the vehicle sale process. Always ensure that all paperwork is completed accurately to avoid any issues down the line.

Misconceptions

Many people have misunderstandings about the Texas Motor Vehicle Bill of Sale form. Here are four common misconceptions:

- It's only needed for private sales. Many believe that a Bill of Sale is only necessary when buying or selling a vehicle privately. However, it can also be beneficial in dealership transactions to document the sale and protect both parties.

- It doesn't need to be notarized. Some think that a Bill of Sale does not require notarization. While it's not mandatory, having it notarized can add an extra layer of security and authenticity to the document.

- It's just a formality. Many see the Bill of Sale as a simple formality. In reality, it serves as a legal record of the transaction, which can be crucial if disputes arise in the future.

- It can be filled out later. Some people believe they can complete the Bill of Sale after the sale has taken place. It's best to fill it out at the time of the transaction to ensure all details are accurate and agreed upon.