Texas Operating Agreement Document

The Texas Operating Agreement form serves as a vital document for limited liability companies (LLCs) operating within the state. This agreement outlines the management structure and operational procedures of the LLC, ensuring that all members are on the same page regarding their rights and responsibilities. Key aspects of the form include the distribution of profits and losses, member voting rights, and the process for adding or removing members. Additionally, it addresses the management roles, whether the LLC is member-managed or manager-managed, and provides guidelines for handling disputes among members. By clearly defining these elements, the Texas Operating Agreement helps to protect the interests of all parties involved, fostering a cooperative business environment and minimizing potential conflicts. Establishing this document is not just a legal formality; it plays a crucial role in the overall success and governance of the LLC.

Discover More Operating Agreement Forms for Different States

Ohio Llc Operating Agreement - The Operating Agreement can address issues of succession planning.

To ensure a smooth application process and enhance your chances of finding the perfect rental, it's essential to understand the importance of completing a Rent Application accurately, as it provides landlords with the necessary information regarding your qualifications as a tenant.

How to Register an Llc - This agreement sets the framework for the duration of the LLC's existence.

Similar forms

- Bylaws: Similar to an Operating Agreement, bylaws outline the rules and procedures for the management of a corporation. They specify how meetings are conducted, how directors are elected, and other governance matters.

- Partnership Agreement: This document governs the relationship between partners in a partnership. Like an Operating Agreement, it details the roles, responsibilities, and profit-sharing arrangements among partners.

- Prenuptial Agreement: An All Ohio Forms serves a similar function in personal relationships as an Operating Agreement does in business, establishing clear expectations regarding assets and responsibilities before entering into a binding contract such as marriage.

- Shareholders Agreement: This agreement is used in corporations to define the rights and obligations of shareholders. It can include buy-sell provisions and voting rights, much like the provisions in an Operating Agreement for LLC members.

- Membership Certificate: This document serves as proof of ownership in an LLC. It is similar to an Operating Agreement in that it establishes member rights and can outline the transfer of ownership interests.

- Business Plan: While primarily a strategic document, a business plan can include operational details and management structure. It aligns with the Operating Agreement by outlining the vision and operational goals of the business.

- Non-Disclosure Agreement (NDA): An NDA protects confidential information shared between parties. Like an Operating Agreement, it establishes clear terms and expectations for parties involved in a business relationship.

- Employment Agreement: This document outlines the terms of employment between an employer and an employee. Similar to an Operating Agreement, it defines roles, responsibilities, and compensation structures.

- Joint Venture Agreement: This agreement outlines the terms of a partnership between two or more parties for a specific project. It shares similarities with an Operating Agreement in defining roles, contributions, and profit-sharing among the parties involved.

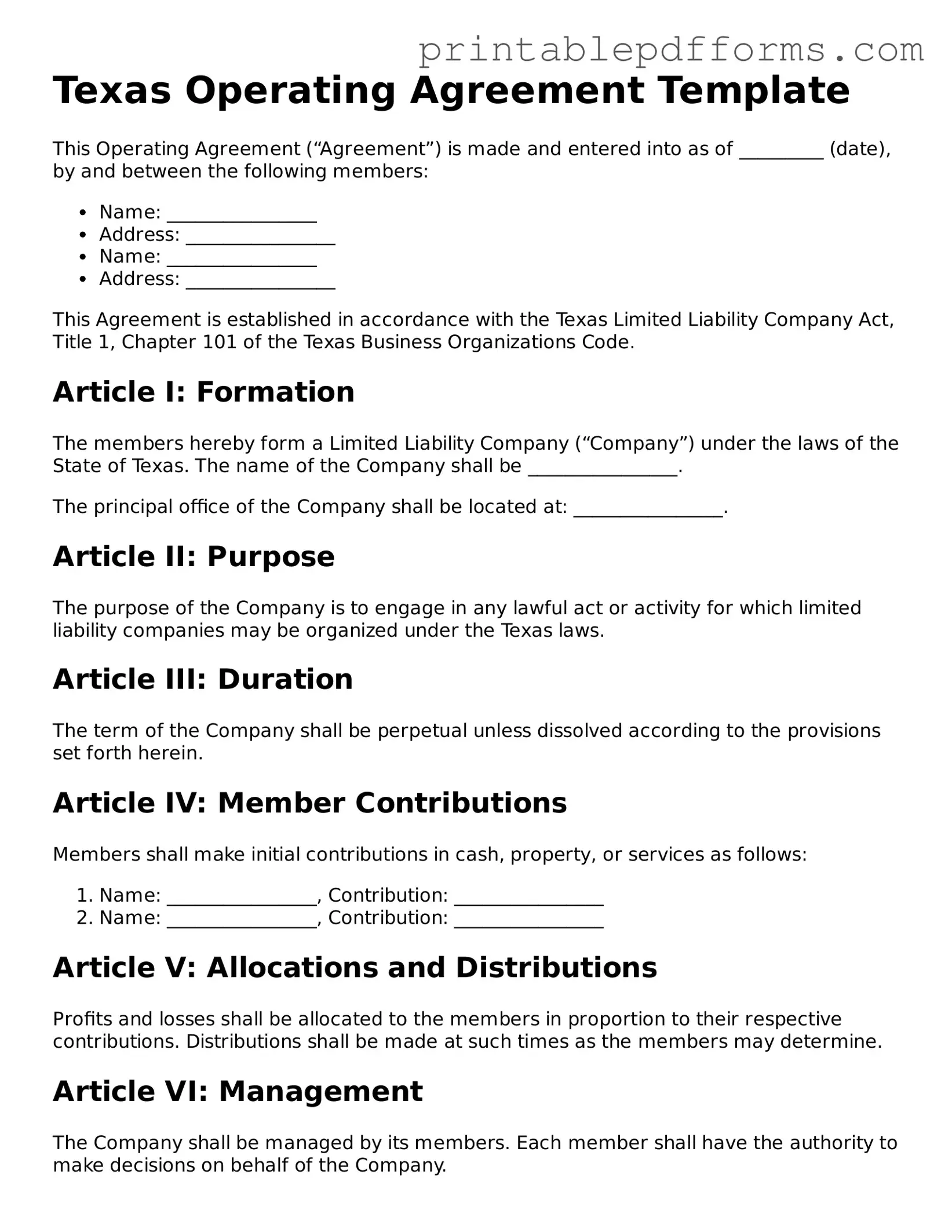

Document Example

Texas Operating Agreement Template

This Operating Agreement (“Agreement”) is made and entered into as of _________ (date), by and between the following members:

- Name: ________________

- Address: ________________

- Name: ________________

- Address: ________________

This Agreement is established in accordance with the Texas Limited Liability Company Act, Title 1, Chapter 101 of the Texas Business Organizations Code.

Article I: Formation

The members hereby form a Limited Liability Company (“Company”) under the laws of the State of Texas. The name of the Company shall be ________________.

The principal office of the Company shall be located at: ________________.

Article II: Purpose

The purpose of the Company is to engage in any lawful act or activity for which limited liability companies may be organized under the Texas laws.

Article III: Duration

The term of the Company shall be perpetual unless dissolved according to the provisions set forth herein.

Article IV: Member Contributions

Members shall make initial contributions in cash, property, or services as follows:

- Name: ________________, Contribution: ________________

- Name: ________________, Contribution: ________________

Article V: Allocations and Distributions

Profits and losses shall be allocated to the members in proportion to their respective contributions. Distributions shall be made at such times as the members may determine.

Article VI: Management

The Company shall be managed by its members. Each member shall have the authority to make decisions on behalf of the Company.

Article VII: Meetings

Regular meetings of the members shall occur at least annually. Special meetings may be called as needed, with notice provided to all members at least _________ days in advance.

Article VIII: Indemnification

The Company shall indemnify any member or agent against expenses and liabilities incurred in connection with the Company, except in matters arising from gross negligence or willful misconduct.

Article IX: Amendment

This Agreement may be amended only with the consent of all members, and all amendments shall be in writing.

Article X: Miscellaneous

This Agreement constitutes the entire agreement among the members and supersedes all prior agreements. The validity and interpretation of this Agreement shall be governed by the laws of the State of Texas.

IN WITNESS WHEREOF, the members have executed this Agreement as of the date first above written.

____________________________________

Name: ________________

____________________________________

Name: ________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Texas Operating Agreement outlines the management structure and operational procedures for a limited liability company (LLC) in Texas. |

| Governing Law | This form is governed by the Texas Business Organizations Code. |

| Importance | Having an Operating Agreement helps protect members' rights and clarifies the rules for the LLC's operation. |

| Flexibility | Texas allows LLCs to customize their Operating Agreements to fit their specific needs and preferences. |

Crucial Questions on This Form

What is a Texas Operating Agreement?

A Texas Operating Agreement is a crucial document for Limited Liability Companies (LLCs) in Texas. It outlines the management structure, ownership, and operational procedures of the LLC. While it is not legally required, having one can help prevent disputes among members and provide clarity on how the business should be run.

Why do I need an Operating Agreement for my LLC?

An Operating Agreement serves several important purposes:

- It clarifies the roles and responsibilities of each member.

- It outlines how profits and losses will be distributed.

- It provides a framework for resolving disputes.

- It helps establish credibility with banks and investors.

In essence, it acts as a roadmap for your business operations.

Who should draft the Operating Agreement?

The Operating Agreement should ideally be drafted by the members of the LLC. However, consulting with a legal professional can ensure that the document meets all necessary legal standards and adequately reflects the members' intentions. This is particularly important if your LLC has multiple members or complex operations.

What should be included in a Texas Operating Agreement?

A comprehensive Texas Operating Agreement should cover the following key elements:

- The name and purpose of the LLC.

- The names and contributions of all members.

- Management structure (member-managed or manager-managed).

- Voting rights and decision-making processes.

- Distribution of profits and losses.

- Procedures for adding or removing members.

- Dispute resolution methods.

- Amendment procedures for the agreement.

Including these elements can help ensure that all members are on the same page.

Is an Operating Agreement legally binding?

Yes, an Operating Agreement is legally binding among the members of the LLC. Once all parties sign the document, it becomes a contract that outlines the agreed-upon terms. However, it is essential that the agreement complies with Texas laws to be enforceable.

How can I amend my Operating Agreement?

Amending an Operating Agreement typically requires a vote among the members, as outlined in the original document. It’s crucial to follow the amendment procedures specified in the agreement. Once agreed upon, all members should sign the amended document to ensure its validity.

What happens if I don’t have an Operating Agreement?

Operating without an agreement can lead to confusion and conflict among members. In the absence of an Operating Agreement, Texas default laws will govern the LLC. This may not reflect the members' intentions and could result in unintended consequences, such as unequal profit distribution or management issues.

Can I create an Operating Agreement myself?

Yes, you can create an Operating Agreement yourself. Many templates are available online, and you can customize them to fit your LLC’s needs. However, it is advisable to have a legal professional review the document to ensure it complies with Texas law and adequately protects your interests.

Documents used along the form

When establishing a business in Texas, particularly a limited liability company (LLC), an Operating Agreement is a crucial document. However, several other forms and documents often accompany it to ensure smooth operation and compliance with state laws. Here’s a look at some of these important documents.

- Certificate of Formation: This is the foundational document filed with the Texas Secretary of State to officially create your LLC. It includes basic information such as the company name, registered agent, and purpose of the business.

- Employer Identification Number (EIN): Issued by the IRS, an EIN is essential for tax purposes. It allows your LLC to open a bank account, hire employees, and file taxes.

- Membership Certificate: This document serves as proof of ownership for members of the LLC. It outlines each member's share and rights within the company.

- Bylaws: While not mandatory for an LLC, bylaws can help outline the internal management structure and procedures of the business, detailing how decisions are made and how meetings are conducted.

- Living Will Form: For those wishing to define their healthcare preferences, utilize the detailed Living Will resources to ensure your wishes are respected during critical times.

- Meeting Minutes: Keeping a record of meetings is vital for transparency and governance. Meeting minutes document decisions made during meetings, providing a historical account of the company’s operations.

- Operating Procedures: This document outlines the day-to-day operational procedures of the LLC. It can include policies on employee conduct, customer service, and other operational guidelines.

- Member Buy-Sell Agreement: This agreement provides a plan for what happens if a member wants to leave the LLC or if certain triggering events occur. It helps prevent disputes and ensures a smooth transition of ownership.

- State and Local Business Licenses: Depending on your business type and location, you may need various licenses or permits to operate legally. These can include health permits, zoning permits, or professional licenses.

- Tax Documents: Various tax forms may be required for state and federal compliance, including sales tax permits and annual franchise tax reports specific to Texas LLCs.

Having these documents in order not only helps in the initial setup of your LLC but also ensures ongoing compliance with legal requirements. Each document plays a role in protecting your business and clarifying the responsibilities of its members.

Misconceptions

When it comes to the Texas Operating Agreement form, several misconceptions can lead to confusion. Understanding these misconceptions is crucial for anyone involved in business operations in Texas.

-

Misconception 1: The Texas Operating Agreement is optional for all businesses.

While it is true that not all businesses are legally required to have an Operating Agreement, it is highly recommended for LLCs. This document outlines the management structure and operational procedures, helping to prevent disputes among members.

-

Misconception 2: An Operating Agreement is the same as a business plan.

This is not accurate. A business plan focuses on the overall strategy and goals of a business, while an Operating Agreement specifically details the internal workings and governance of the LLC.

-

Misconception 3: Once an Operating Agreement is created, it cannot be changed.

This is a common misunderstanding. An Operating Agreement can be amended as needed, allowing members to adapt to changes in the business or its environment.

-

Misconception 4: The Operating Agreement does not need to be filed with the state.

Correct, the Operating Agreement is a private document and does not need to be submitted to the state. However, keeping it on file is important for internal reference and potential legal matters.

Addressing these misconceptions can help ensure that business owners are better prepared and informed about their responsibilities and rights under Texas law.