Texas Power of Attorney Document

In Texas, the Power of Attorney form serves as a crucial legal document that empowers individuals to designate someone else to make decisions on their behalf, especially in matters related to financial, medical, or legal affairs. This form can be tailored to meet specific needs, allowing the principal—the person granting the authority—to choose the extent of powers they wish to confer. Whether it’s managing bank accounts, selling property, or making healthcare decisions, the Texas Power of Attorney can be customized to suit various situations. Importantly, this document can be durable, meaning it remains effective even if the principal becomes incapacitated, or it can be limited to specific tasks or a designated timeframe. Understanding the nuances of this form is essential for anyone considering designating a trusted individual to act on their behalf, ensuring that their wishes are respected and their interests protected. With proper execution and careful consideration, the Texas Power of Attorney can provide peace of mind, knowing that someone you trust will be able to handle your affairs when you cannot.

Discover More Power of Attorney Forms for Different States

Power of Attorney Form -- Pdf - You may want to limit your agent’s powers to specific tasks or a certain period of time.

Nys Power of Attorney Form - This document can enhance your financial management strategy if created thoughtfully.

Simple Power of Attorney Form Florida - This form may be part of broader advance planning documents like living wills.

The Medical Power of Attorney document is vital for individuals who wish to designate a trusted person to handle their healthcare decisions when they are incapacitated. For those seeking guidance on this process, a helpful resource can be found in the form of a detailed Medical Power of Attorney template that streamlines the completion of this important legal task.

Does a Power of Attorney Need to Be Recorded in Pennsylvania - A Power of Attorney is a vital tool for anyone wishing to control their affairs in advance.

Similar forms

- Living Will: A living will outlines a person's preferences for medical treatment in case they become unable to communicate. Like a Power of Attorney, it addresses health care decisions, but it specifically focuses on end-of-life care.

- Quitclaim Deed: This form allows for the transfer of property ownership without warranty, often used between closely related individuals. For more details, you can find resources like All Ohio Forms.

- Health Care Proxy: This document allows someone to make medical decisions on behalf of another person. Similar to a Power of Attorney, it designates an individual to act in the best interest of another regarding health care matters.

- Durable Power of Attorney: This is a specific type of Power of Attorney that remains effective even if the person becomes incapacitated. It serves a similar purpose but emphasizes the continuation of authority under certain conditions.

- Financial Power of Attorney: This document grants authority to manage financial matters. While a general Power of Attorney can cover both health and financial decisions, a Financial Power of Attorney focuses solely on financial transactions.

- Trust Agreement: A trust agreement allows a person to transfer assets to a trustee for the benefit of beneficiaries. Like a Power of Attorney, it involves the management of assets, but it also includes specific instructions on how those assets should be handled.

Document Example

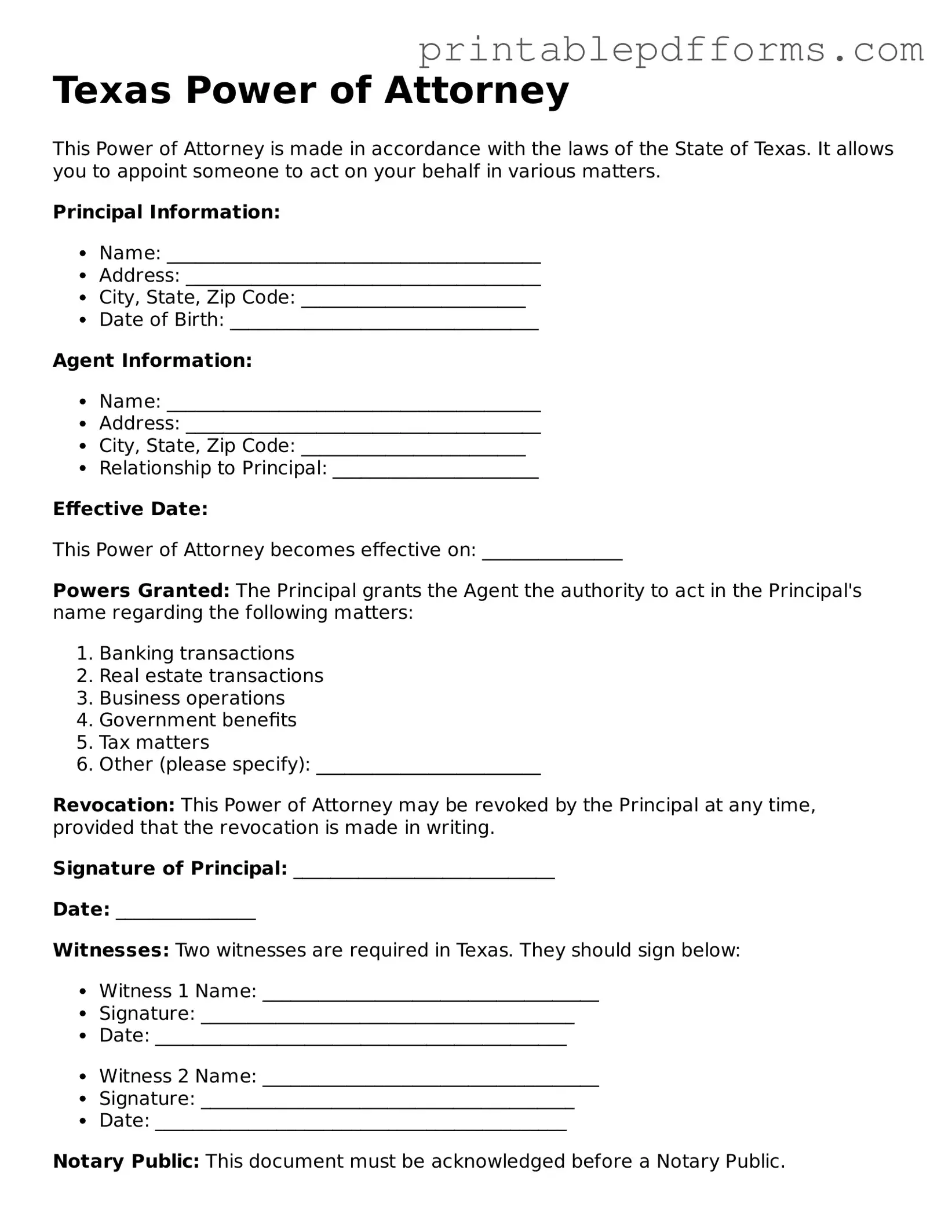

Texas Power of Attorney

This Power of Attorney is made in accordance with the laws of the State of Texas. It allows you to appoint someone to act on your behalf in various matters.

Principal Information:

- Name: ________________________________________

- Address: ______________________________________

- City, State, Zip Code: ________________________

- Date of Birth: _________________________________

Agent Information:

- Name: ________________________________________

- Address: ______________________________________

- City, State, Zip Code: ________________________

- Relationship to Principal: ______________________

Effective Date:

This Power of Attorney becomes effective on: _______________

Powers Granted: The Principal grants the Agent the authority to act in the Principal's name regarding the following matters:

- Banking transactions

- Real estate transactions

- Business operations

- Government benefits

- Tax matters

- Other (please specify): ________________________

Revocation: This Power of Attorney may be revoked by the Principal at any time, provided that the revocation is made in writing.

Signature of Principal: ____________________________

Date: _______________

Witnesses: Two witnesses are required in Texas. They should sign below:

- Witness 1 Name: ____________________________________

- Signature: ________________________________________

- Date: ____________________________________________

- Witness 2 Name: ____________________________________

- Signature: ________________________________________

- Date: ____________________________________________

Notary Public: This document must be acknowledged before a Notary Public.

NOTARY PUBLIC: ______________________________

Date: _______________________________________

Important Notice: This template is for informational purposes only. It is advisable to consult with an attorney to ensure compliance with Texas law and to address specific legal needs.

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | A Texas Power of Attorney is a legal document that allows one person to authorize another to act on their behalf in legal or financial matters. |

| Governing Law | The Texas Power of Attorney is governed by the Texas Estates Code, specifically Chapter 751. |

| Types | There are several types of Power of Attorney in Texas, including Durable, Non-Durable, and Medical Power of Attorney. |

| Durability | A Durable Power of Attorney remains effective even if the principal becomes incapacitated. |

| Agent Authority | The agent can be given broad or limited authority, depending on the principal's preferences outlined in the document. |

| Revocation | The principal can revoke the Power of Attorney at any time, as long as they are mentally competent. |

| Signature Requirement | The document must be signed by the principal and, in some cases, witnessed or notarized to be valid. |

| Importance | A Power of Attorney is important for ensuring that financial and legal decisions can be made on behalf of an individual when they are unable to do so themselves. |

Crucial Questions on This Form

What is a Power of Attorney in Texas?

A Power of Attorney (POA) in Texas is a legal document that allows you to appoint someone else, known as your agent or attorney-in-fact, to make decisions on your behalf. This can include financial matters, medical decisions, or other personal affairs. The document can be tailored to fit your needs, granting broad or limited powers depending on your preferences.

How do I create a Power of Attorney in Texas?

Creating a Power of Attorney in Texas involves several key steps:

- Choose your agent: Select a trustworthy individual who understands your wishes and can act in your best interest.

- Decide on the type: Determine whether you need a general POA, which grants broad powers, or a specific POA, which limits the agent's authority to particular tasks.

- Draft the document: You can use a template or work with an attorney to ensure it meets Texas legal requirements.

- Sign the document: You must sign the POA in front of a notary public. This step is crucial for the document to be legally valid.

Can I revoke a Power of Attorney in Texas?

Yes, you can revoke a Power of Attorney in Texas at any time as long as you are mentally competent. To do this, you should:

- Write a revocation letter stating that you are canceling the existing POA.

- Notify your agent and any institutions or individuals who were relying on the POA.

- Consider creating a new POA if you want to appoint someone else.

It is important to keep a copy of the revocation for your records.

What happens if I become incapacitated without a Power of Attorney?

If you become incapacitated and do not have a Power of Attorney in place, your family may need to go through a legal process called guardianship. This process can be lengthy and costly, and it may not result in the outcome you would have preferred. Having a POA in advance allows you to choose someone you trust to make decisions for you, avoiding potential disputes among family members and ensuring your wishes are followed.

Documents used along the form

A Texas Power of Attorney (POA) is a powerful tool that allows someone to make decisions on your behalf. When creating a POA, there are several other forms and documents that you might consider to ensure your wishes are clearly communicated and legally protected. Here are some common ones:

- Medical Power of Attorney: This document specifically grants someone the authority to make healthcare decisions for you if you become unable to do so yourself. It focuses on medical treatment and end-of-life care preferences.

- Living Will: A living will outlines your wishes regarding medical treatment in situations where you are terminally ill or incapacitated. It helps guide your medical team and loved ones in making decisions that align with your values.

- Durable Power of Attorney: Unlike a standard POA, a durable power of attorney remains effective even if you become incapacitated. It allows your agent to manage your financial affairs, ensuring your bills are paid and assets are protected.

- HIPAA Release Form: This form allows designated individuals to access your medical records and communicate with healthcare providers about your health. It’s essential for coordinating care, especially in emergencies.

- Bill of Sale: The Bill of Sale form is crucial for transferring ownership of personal property, documenting essential transaction details and protecting both buyer and seller.

- Trust Document: A trust can hold and manage your assets for your benefit or for your beneficiaries. Establishing a trust can help avoid probate and provide clear instructions on asset distribution.

- Beneficiary Designation Forms: These forms allow you to specify who will receive your assets upon your death. They are commonly used for life insurance policies, retirement accounts, and bank accounts.

Having these documents in place alongside your Texas Power of Attorney can provide comprehensive support for your personal and financial decisions. It’s important to review your options and ensure that your preferences are clearly articulated in each document.

Misconceptions

Understanding the Texas Power of Attorney form is essential for anyone considering this important legal document. However, several misconceptions often cloud the clarity of its purpose and function. Here are seven common misunderstandings:

- A Power of Attorney is only for financial matters. Many believe that a Power of Attorney can only be used for financial decisions. In reality, it can also cover health care decisions, making it a versatile tool for various situations.

- Once a Power of Attorney is signed, it cannot be changed. This is not true. A Power of Attorney can be revoked or modified at any time, as long as the principal is still mentally competent to do so.

- Power of Attorney grants unlimited power to the agent. While the agent does have significant authority, the powers granted are defined within the document. The principal can specify what the agent can and cannot do.

- All Powers of Attorney are the same. There are different types of Power of Attorney forms, including durable, springing, and medical. Each serves a distinct purpose, tailored to the needs of the principal.

- A Power of Attorney is only useful for elderly individuals. This misconception overlooks the fact that anyone, regardless of age, can benefit from a Power of Attorney. Unexpected events can happen to anyone, making this document relevant for all adults.

- My agent must be a lawyer. While many people choose attorneys as their agents, it is not a requirement. Any trusted individual can serve as an agent, provided they are of sound mind and legal age.

- Once I give someone Power of Attorney, they can act immediately. This depends on the type of Power of Attorney. A durable Power of Attorney allows immediate action, while a springing Power of Attorney only becomes effective under specific conditions, such as incapacity.

By dispelling these misconceptions, individuals can make informed decisions about their Power of Attorney needs. Understanding the true nature of this document can empower people to plan for the future with confidence.