Texas Promissory Note Document

The Texas Promissory Note is a crucial financial document that outlines the terms under which one party borrows money from another. This form establishes a clear agreement between the lender and borrower, specifying the principal amount, interest rate, and repayment schedule. It includes essential details such as the due date for payments and any applicable late fees, ensuring both parties understand their obligations. Additionally, the Texas Promissory Note may address conditions for default, which protects the lender's interests while providing the borrower with clarity on the consequences of missed payments. By utilizing this form, individuals and businesses can create a legally binding agreement that fosters trust and accountability in financial transactions.

Discover More Promissory Note Forms for Different States

New York Promissory Note Requirements - For small businesses, a promissory note can be an effective way to secure necessary funding from private lenders.

When engaging in the sale of a vehicle in Texas, it is crucial to utilize the Texas Motor Vehicle Bill of Sale form to ensure clarity and legality in the transaction. This document signifies both parties' agreement and should include thorough details such as buyer and seller information, vehicle specifications, and the sale price. For more information and to access a blank copy of the form, visit https://freebusinessforms.org/.

Florida Promissory Note Requirements - This document outlines the terms of a loan between a borrower and a lender.

Ohio Promissory Note Requirements - Both parties should understand their rights and obligations as outlined in the note.

Promissory Note Form California - Many financial institutions utilize Promissory Notes as standard lending practice.

Similar forms

- Loan Agreement: A loan agreement outlines the terms and conditions of a loan between a lender and a borrower. Like a promissory note, it specifies the amount borrowed, the interest rate, and the repayment schedule. However, it often includes more detailed provisions regarding the obligations of both parties.

- Mortgage: A mortgage is a legal document that secures a loan against real property. Similar to a promissory note, it involves a promise to repay a loan. However, a mortgage also grants the lender a lien on the property, providing them with a right to take possession if the borrower defaults.

- Security Agreement: A security agreement is a contract that allows a lender to take collateral in exchange for a loan. This document, like a promissory note, establishes a debtor's obligation to repay. However, it specifically details the collateral that secures the loan, which is not typically addressed in a promissory note.

- WC-200A Georgia Form: This essential document is used to request a change of physician or additional treatment in workers' compensation cases. For more information, visit georgiapdf.com/wc-200a-georgia to ensure your rights are protected.

- Installment Agreement: An installment agreement is a contract that allows a borrower to repay a debt in regular installments over time. Similar to a promissory note, it outlines the total amount owed and the repayment schedule. However, it may also include additional terms regarding penalties for late payments or default.

- Personal Guarantee: A personal guarantee is a promise made by an individual to repay another person's debt if that person defaults. Like a promissory note, it creates a personal obligation to pay. However, it typically applies to business loans and emphasizes the personal liability of the guarantor.

Document Example

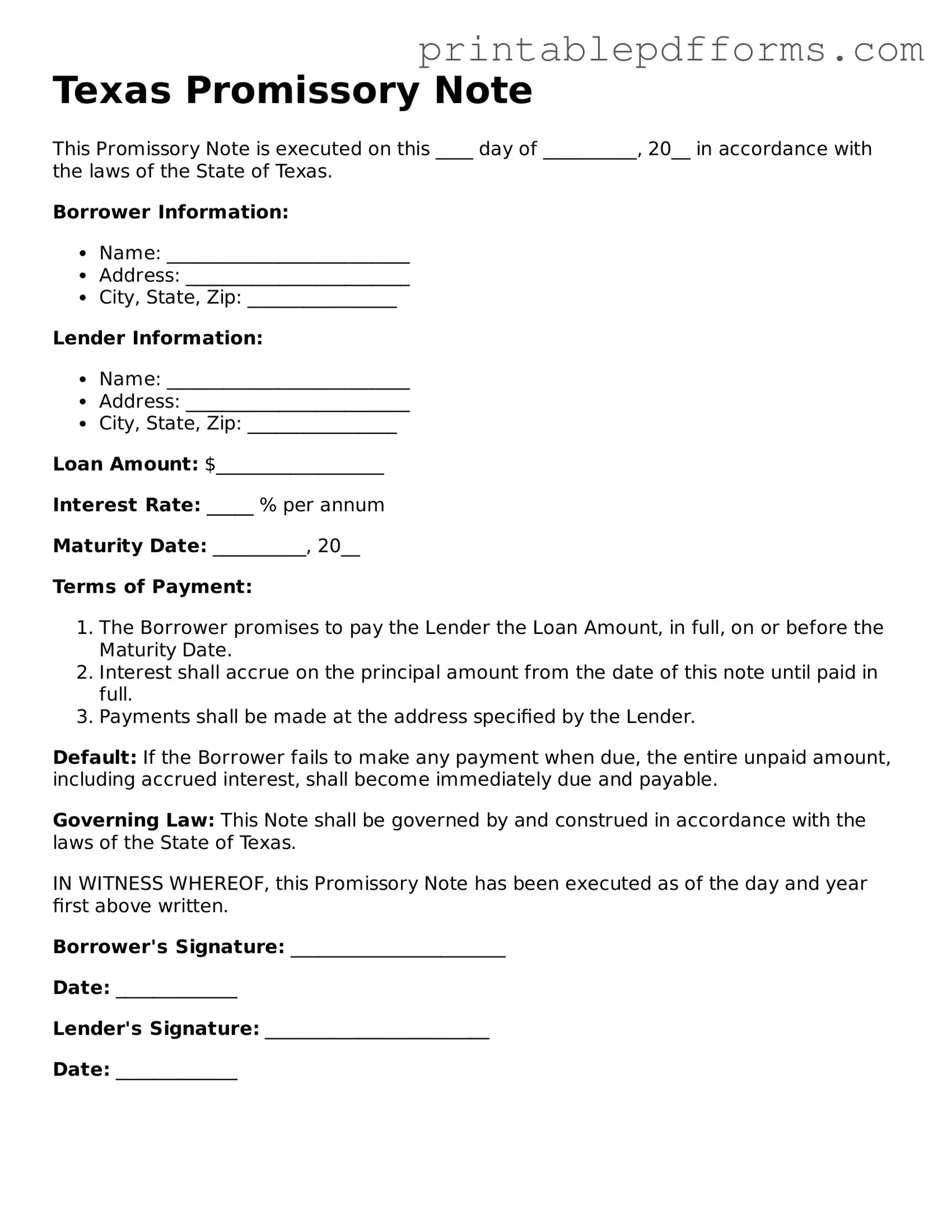

Texas Promissory Note

This Promissory Note is executed on this ____ day of __________, 20__ in accordance with the laws of the State of Texas.

Borrower Information:

- Name: __________________________

- Address: ________________________

- City, State, Zip: ________________

Lender Information:

- Name: __________________________

- Address: ________________________

- City, State, Zip: ________________

Loan Amount: $__________________

Interest Rate: _____ % per annum

Maturity Date: __________, 20__

Terms of Payment:

- The Borrower promises to pay the Lender the Loan Amount, in full, on or before the Maturity Date.

- Interest shall accrue on the principal amount from the date of this note until paid in full.

- Payments shall be made at the address specified by the Lender.

Default: If the Borrower fails to make any payment when due, the entire unpaid amount, including accrued interest, shall become immediately due and payable.

Governing Law: This Note shall be governed by and construed in accordance with the laws of the State of Texas.

IN WITNESS WHEREOF, this Promissory Note has been executed as of the day and year first above written.

Borrower's Signature: _______________________

Date: _____________

Lender's Signature: ________________________

Date: _____________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Texas Promissory Note is a written promise to pay a specified amount of money to a designated party at a future date or on demand. |

| Governing Law | The Texas Promissory Note is governed by the Texas Business and Commerce Code, specifically Chapter 3, which covers negotiable instruments. |

| Interest Rates | Interest rates on a Texas Promissory Note may be specified within the document, but they must comply with Texas usury laws to avoid excessive charges. |

| Enforceability | A properly executed Texas Promissory Note is legally enforceable in a court of law, provided it meets all necessary legal requirements. |

Crucial Questions on This Form

What is a Texas Promissory Note?

A Texas Promissory Note is a written agreement in which one party (the borrower) promises to pay a specific amount of money to another party (the lender) at a predetermined time or on demand. This document outlines the terms of the loan, including the interest rate, repayment schedule, and any collateral involved. It serves as a legal record of the debt and the obligations of both parties.

Who can use a Texas Promissory Note?

Any individual or business that wishes to lend or borrow money can use a Texas Promissory Note. This includes personal loans between friends or family members, business loans, or loans for real estate transactions. It is important that both parties fully understand the terms outlined in the note before signing.

What are the key components of a Texas Promissory Note?

A Texas Promissory Note typically includes the following key components:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The rate at which interest will accrue on the principal amount.

- Repayment Terms: The schedule for when payments are due, including any grace periods.

- Default Terms: The conditions under which the borrower would be considered in default.

- Signatures: Signatures of both the borrower and lender, indicating their agreement to the terms.

Is a Texas Promissory Note legally binding?

Yes, a Texas Promissory Note is legally binding as long as it meets certain requirements. For the note to be enforceable, it must be in writing, signed by the borrower, and include all essential terms. If these criteria are met, the lender can take legal action to recover the debt if the borrower fails to repay as agreed.

Can a Texas Promissory Note be modified after it is signed?

Yes, a Texas Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended note. This helps prevent misunderstandings and provides a clear record of the updated terms.

What happens if the borrower defaults on the Texas Promissory Note?

If the borrower defaults on the Texas Promissory Note, the lender has several options. They can initiate legal proceedings to recover the owed amount, which may include filing a lawsuit. Additionally, if the note includes collateral, the lender may have the right to seize the collateral to satisfy the debt. It's essential for lenders to understand their rights and the specific terms outlined in the note regarding default.

Where can I obtain a Texas Promissory Note form?

Texas Promissory Note forms can be obtained from various sources, including legal stationery stores, online legal document providers, or through an attorney. It is crucial to ensure that the form complies with Texas laws and includes all necessary terms specific to your agreement. Customizing a template to fit your situation is often recommended to ensure clarity and legality.

Documents used along the form

When engaging in a loan agreement in Texas, the Promissory Note is a crucial document. However, it often works in conjunction with other important forms and documents that help clarify the terms and protect the interests of both parties involved. Below are some common documents you might encounter alongside a Texas Promissory Note.

- Security Agreement: This document outlines the collateral that secures the loan. If the borrower defaults, the lender can take possession of the specified assets. It provides assurance to the lender that they have a claim to the borrower's property in case of non-payment.

- Loan Agreement: A more detailed contract than the Promissory Note, the Loan Agreement specifies the terms of the loan, including interest rates, repayment schedules, and any fees. It serves as a comprehensive guide for both parties, ensuring that everyone understands their rights and responsibilities.

- Notice to Quit: This is a crucial legal document for landlords seeking to evict tenants who have violated their lease agreement or failed to pay rent, ensuring a formal process is followed. For more information, refer to All Ohio Forms.

- Disclosure Statement: This document provides borrowers with important information about the loan, including the total cost of the loan, interest rates, and any potential penalties for late payments. It ensures transparency and helps borrowers make informed decisions.

- Guaranty Agreement: In some cases, a lender may require a third party to guarantee the loan. This document outlines the obligations of the guarantor, who agrees to repay the loan if the borrower defaults. It adds an extra layer of security for the lender.

Understanding these accompanying documents can greatly enhance your experience in the lending process. Each one plays a vital role in ensuring clarity and protection for both borrowers and lenders. Being informed about these forms can lead to a smoother transaction and a more secure financial arrangement.

Misconceptions

Understanding the Texas Promissory Note form is crucial for anyone involved in lending or borrowing money in Texas. However, several misconceptions often arise regarding this important document. Below are five common misconceptions and clarifications for each.

-

All Promissory Notes are the Same:

Many people believe that all promissory notes are identical. In reality, they can vary significantly based on the terms agreed upon by the parties involved. The Texas Promissory Note form includes specific provisions that cater to Texas laws and practices.

-

A Promissory Note Does Not Require Signatures:

Some individuals think that a promissory note can be valid without signatures. However, for a promissory note to be enforceable, it must be signed by both the borrower and the lender. This signature indicates agreement to the terms outlined in the document.

-

Verbal Agreements are Sufficient:

Another misconception is that verbal agreements can replace a written promissory note. While verbal agreements can be binding, they are difficult to enforce and prove in court. A written promissory note provides clear evidence of the terms and conditions.

-

Promissory Notes are Only for Large Loans:

Many believe that promissory notes are only necessary for large sums of money. In fact, they can be used for any amount, whether it’s a small personal loan or a larger business transaction. Having a written record is always advisable.

-

Interest Rates are Optional:

Some people think that including an interest rate in a promissory note is optional. However, if the lender expects to receive interest, it should be clearly stated in the note. Otherwise, the loan may be considered a gift, and the lender may lose the right to collect interest.