Texas Quitclaim Deed Document

In the realm of real estate transactions in Texas, the Quitclaim Deed form serves as a vital tool for property owners looking to transfer their interest in a property without the complexities often associated with other types of deeds. This form is particularly useful when the parties involved have a clear understanding of the property’s title status, as it conveys whatever interest the grantor has, if any, without guaranteeing that the title is free from defects. The Quitclaim Deed can facilitate a variety of scenarios, such as transferring property between family members, clearing up title issues, or even resolving disputes. Importantly, the form requires specific information, including the names of the parties involved, a legal description of the property, and the signature of the grantor, ensuring that the transaction is legally recognized. While it may appear straightforward, understanding the nuances of this deed is crucial for both grantors and grantees, as it impacts their rights and responsibilities regarding the property. With the right knowledge, individuals can navigate the process effectively, ensuring that their intentions are clearly documented and legally binding.

Discover More Quitclaim Deed Forms for Different States

Pennsylvania Quit Claim Deed Form - In a business setting, this deed may be used to transfer interests in partnership assets.

For those interested in starting a business, understanding the filing process is crucial. A vital document in this regard is the essential Articles of Incorporation form, which lays the groundwork for establishing a corporation in Washington. You can find more information by visiting this resource about Articles of Incorporation.

How Much Does a Quick Deed Cost - This deed does not involve any consideration (payment) typically.

Quitclaim Deed Ny - Quitclaim Deeds are recognized and valid in every state.

Florida Quit Claim Deed Filled Out - It is commonly used among family members or business partners to simplify transfers.

Similar forms

A Quitclaim Deed is a specific type of legal document used to transfer ownership of real estate. While it serves its own unique purpose, there are several other documents that share similarities with it. Here are five documents that are comparable to a Quitclaim Deed:

- Warranty Deed: Like a Quitclaim Deed, a Warranty Deed transfers property ownership. However, it provides a guarantee that the seller has clear title to the property and can defend against any claims. This makes it more secure for the buyer.

- Medical Power of Attorney Form: To ensure your healthcare decisions align with your wishes, utilize the essential Medical Power of Attorney form resources that guide you through the process of appointing a decision-maker.

- Grant Deed: A Grant Deed also conveys property ownership. It includes assurances that the property has not been sold to anyone else and that there are no undisclosed encumbrances. This is similar to the Quitclaim Deed in that it facilitates the transfer of ownership, but it offers more protection.

- Deed of Trust: A Deed of Trust is used to secure a loan with real property. While it serves a different purpose than a Quitclaim Deed, both documents involve the transfer of an interest in real estate. In this case, the property is held as collateral for a loan.

- Life Estate Deed: A Life Estate Deed grants ownership of property for the duration of a person’s life. After their passing, the property automatically transfers to another party. Similar to a Quitclaim Deed, it facilitates a transfer of property rights but is specific to the lifetime of the grantor.

- Bill of Sale: While primarily used for personal property, a Bill of Sale transfers ownership from one party to another. It shares the same fundamental purpose of transferring ownership as a Quitclaim Deed, but it is typically used for items like vehicles or equipment rather than real estate.

Document Example

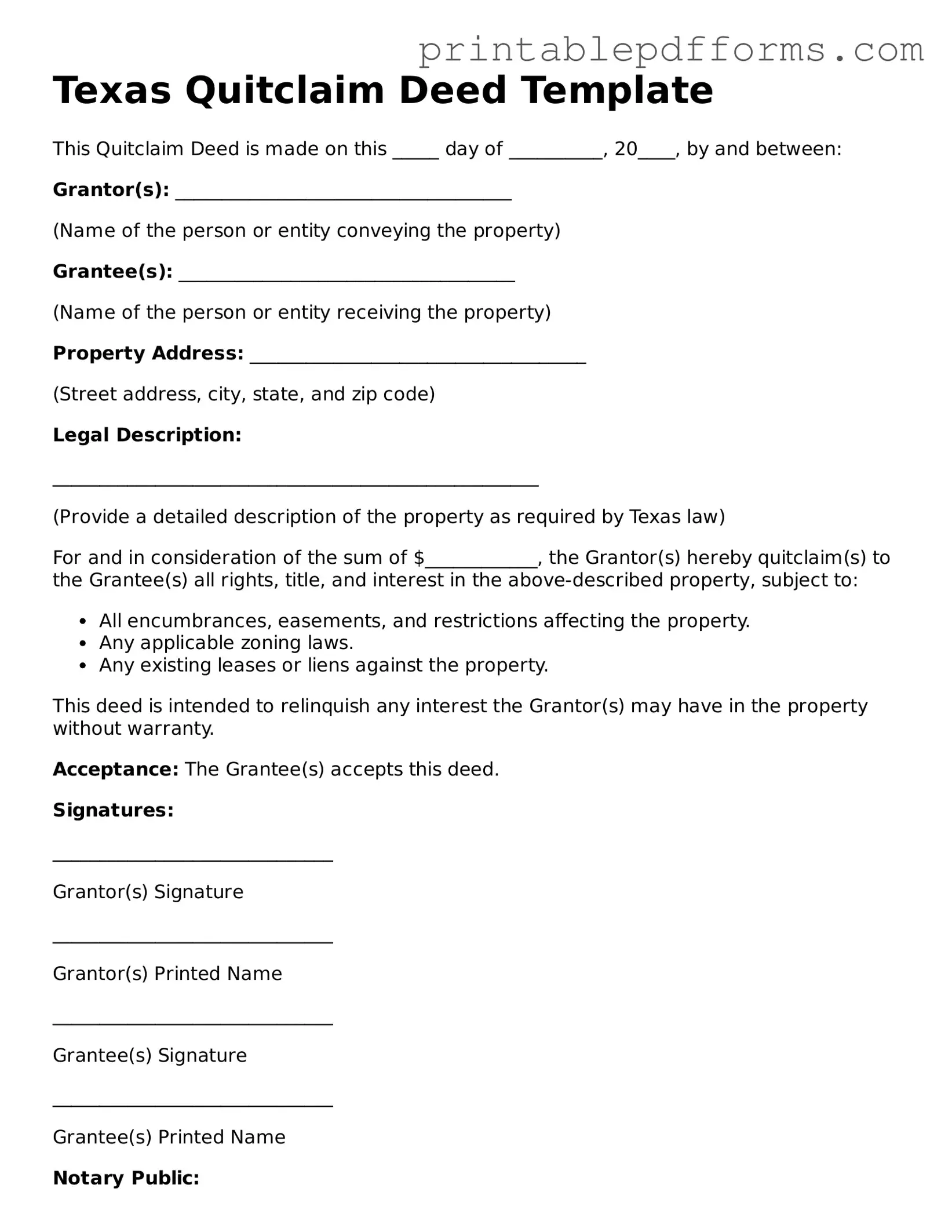

Texas Quitclaim Deed Template

This Quitclaim Deed is made on this _____ day of __________, 20____, by and between:

Grantor(s): ____________________________________

(Name of the person or entity conveying the property)

Grantee(s): ____________________________________

(Name of the person or entity receiving the property)

Property Address: ____________________________________

(Street address, city, state, and zip code)

Legal Description:

____________________________________________________

(Provide a detailed description of the property as required by Texas law)

For and in consideration of the sum of $____________, the Grantor(s) hereby quitclaim(s) to the Grantee(s) all rights, title, and interest in the above-described property, subject to:

- All encumbrances, easements, and restrictions affecting the property.

- Any applicable zoning laws.

- Any existing leases or liens against the property.

This deed is intended to relinquish any interest the Grantor(s) may have in the property without warranty.

Acceptance: The Grantee(s) accepts this deed.

Signatures:

______________________________

Grantor(s) Signature

______________________________

Grantor(s) Printed Name

______________________________

Grantee(s) Signature

______________________________

Grantee(s) Printed Name

Notary Public:

State of Texas, County of ___________.

Before me, the undersigned authority, personally appeared ___________, known to me to be the person(s) whose name(s) is/are subscribed to the foregoing instrument and acknowledged to me that he/she/they executed the same for the purposes and consideration therein expressed.

Given under my hand and seal of office this _____ day of __________, 20____.

______________________________

Notary Public, State of Texas

My commission expires: ________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Texas Quitclaim Deed transfers ownership of real estate without any guarantees about the title. |

| Governing Law | The Texas Quitclaim Deed is governed by the Texas Property Code, specifically Chapter 5. |

| Purpose | This deed is often used to clear up title issues or transfer property between family members. |

| Parties Involved | Two parties are involved: the grantor (seller) and the grantee (buyer). |

| Consideration | The deed does not require a specific consideration amount, but it must state that something of value is exchanged. |

| Signature Requirement | The grantor must sign the deed in front of a notary public for it to be valid. |

| Recording | To protect the grantee's interest, the deed should be recorded with the county clerk's office. |

| Limitations | A quitclaim deed does not guarantee that the grantor has a valid title to the property. |

| Tax Implications | Transfer taxes may apply, and it is advisable to check local regulations regarding taxation. |

| Common Uses | Commonly used in divorce settlements, estate planning, or to transfer property to a trust. |

Crucial Questions on This Form

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the person transferring the property has clear title to it. Instead, it simply conveys whatever interest the grantor has in the property, if any. This makes it a quick way to transfer property, often used among family members or in divorce settlements.

When should I use a Quitclaim Deed?

Quitclaim Deeds are commonly used in several situations, including:

- Transferring property between family members, such as parents to children.

- Removing a former spouse from the title after a divorce.

- Clearing up title issues when the ownership is unclear.

- Transferring property into a trust.

What are the requirements for a Quitclaim Deed in Texas?

In Texas, a Quitclaim Deed must meet certain requirements to be valid. These include:

- Identification of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- A clear description of the property being transferred.

- The signature of the grantor, which must be notarized.

- Filing the deed with the county clerk in the county where the property is located.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to sell it. In contrast, a Quitclaim Deed offers no such assurances. It is important to understand these differences before deciding which type of deed to use.

Can I revoke a Quitclaim Deed after it has been executed?

Once a Quitclaim Deed has been executed and recorded, it generally cannot be revoked unilaterally. If you wish to reverse the transaction, you may need to execute another deed that transfers the property back to the original owner. This can be complicated and may require legal advice.

Do I need an attorney to prepare a Quitclaim Deed?

While it is not legally required to have an attorney prepare a Quitclaim Deed, consulting with one can be beneficial. An attorney can ensure that the deed is completed correctly and meets all legal requirements. This can help prevent potential disputes or issues in the future.

How much does it cost to file a Quitclaim Deed in Texas?

The cost to file a Quitclaim Deed in Texas varies by county. Generally, you can expect to pay a filing fee, which may range from $15 to $30. Additional fees may apply for copies or other services. It is advisable to check with your local county clerk's office for specific fee information.

What happens after I file a Quitclaim Deed?

After filing a Quitclaim Deed, the county clerk will record the document, which makes the transfer of ownership official. The new owner will then have the legal rights associated with the property. It is wise to keep a copy of the filed deed for your records.

Can a Quitclaim Deed be used for transferring property into a trust?

Yes, a Quitclaim Deed can be used to transfer property into a trust. This is often done to manage assets more efficiently or to avoid probate. However, it is important to ensure that the trust is properly established and that the deed is correctly executed to avoid any complications.

Are there tax implications when using a Quitclaim Deed?

There can be tax implications when using a Quitclaim Deed, particularly regarding property taxes and potential gift taxes. It is advisable to consult with a tax professional to understand how the transfer may affect your tax situation and to ensure compliance with all applicable laws.

Documents used along the form

The Texas Quitclaim Deed is a crucial document for transferring property ownership. However, several other forms and documents are often used in conjunction with it to ensure a smooth transaction. Below is a list of these important documents, each serving a unique purpose in the property transfer process.

- Property Title Search: This document confirms the current ownership of the property and identifies any liens or claims against it. A title search helps ensure that the seller has the right to transfer the property.

- Title Insurance Policy: This policy protects the buyer against any future claims or disputes over property ownership. It is an essential safeguard for the buyer's investment.

- Quitclaim Deed Form: This form is essential for transferring ownership rights in real estate without title guarantees. For Ohio residents, you can find the necessary document through All Ohio Forms.

- Affidavit of Heirship: Used when property is inherited, this document establishes the rightful heirs of a deceased owner. It can help clarify ownership in the absence of a will.

- Sales Contract: This agreement outlines the terms of the property sale, including price and conditions. It serves as a binding contract between the buyer and seller.

- Notice of Transfer: This document informs local authorities about the change in property ownership. It ensures that tax records are updated accordingly.

- Property Disclosure Statement: This statement provides information about the property's condition. Sellers disclose any known issues to the buyer, promoting transparency in the transaction.

- IRS Form 1099-S: This form reports the sale of real estate to the Internal Revenue Service. It is necessary for tax purposes and must be filed by the seller.

Each of these documents plays a vital role in the property transfer process. Understanding their purposes can help ensure that all legal requirements are met and that both parties feel secure in the transaction.

Misconceptions

Understanding the Texas Quitclaim Deed form can be challenging, especially with many misconceptions floating around. Here are nine common misunderstandings about this legal document:

-

A Quitclaim Deed Transfers Ownership Completely.

Many believe that a quitclaim deed guarantees a full transfer of ownership. However, it only conveys whatever interest the grantor has at the time of the transfer. If the grantor has no ownership interest, the recipient receives nothing.

-

Quitclaim Deeds Are Only for Family Transfers.

While quitclaim deeds are often used among family members, they can also be utilized in various transactions, including sales and transfers between strangers.

-

Quitclaim Deeds Are Only Used in Texas.

This form is not exclusive to Texas. Quitclaim deeds are recognized in many states across the U.S., each with its own rules and regulations.

-

Quitclaim Deeds Eliminate All Liabilities.

Some people think that using a quitclaim deed absolves the grantor of any liabilities tied to the property. In reality, existing liens or mortgages remain attached to the property, regardless of the deed.

-

All Quitclaim Deeds Must Be Notarized.

While notarization is a common practice, it is not always legally required for a quitclaim deed to be valid in Texas. However, having it notarized is highly recommended for added protection.

-

Quitclaim Deeds Are Irrevocable.

Some believe that once a quitclaim deed is signed, it cannot be undone. In fact, the grantor may have options to revoke or challenge the deed under certain circumstances.

-

A Quitclaim Deed Can Be Used to Clear Title Issues.

This misconception suggests that a quitclaim deed can resolve title problems. However, it does not guarantee a clear title and may even complicate matters further.

-

Using a Quitclaim Deed Is Simple and Always Safe.

While the process may seem straightforward, it can lead to significant issues if not handled correctly. Legal advice is often beneficial to navigate the complexities involved.

-

Quitclaim Deeds Are Only for Real Estate.

Although they are most commonly associated with real estate, quitclaim deeds can also be used for transferring interests in other types of property, such as vehicles or personal belongings.

Being informed about these misconceptions can help individuals make better decisions when it comes to property transfers in Texas.