Texas Real Estate Purchase Agreement Document

The Texas Real Estate Purchase Agreement form serves as a crucial document in the real estate transaction process, outlining the terms and conditions under which a property is bought and sold. This form typically includes essential details such as the purchase price, financing terms, and the closing date, ensuring that both buyers and sellers have a clear understanding of their obligations. Additionally, it addresses contingencies, which are conditions that must be met for the sale to proceed, such as inspections or financing approvals. The agreement also covers earnest money, a deposit made by the buyer to demonstrate their serious intent to purchase, and outlines the rights and responsibilities of both parties throughout the transaction. By including provisions related to property disclosures and title insurance, the form helps protect the interests of all involved. Understanding the components of this agreement is vital for anyone participating in a real estate transaction in Texas, as it lays the groundwork for a successful transfer of property ownership.

Discover More Real Estate Purchase Agreement Forms for Different States

How to Make a Purchase Agreement - This document includes a description of the property being sold, including its address and any unique features.

To facilitate the transfer process and protect your interests, it is advisable to use a reliable format for the Arizona Motorcycle Bill of Sale, which you can find at Top Document Templates. This ensures that all necessary information is properly documented, making the transaction seamless for both parties involved.

Midland Title Toledo - Details any contingencies for renting the property post-purchase.

Similar forms

- Lease Agreement: Similar to a Real Estate Purchase Agreement, a lease agreement outlines the terms under which a tenant may occupy a property. Both documents specify duration, payment terms, and responsibilities of each party.

- Option Agreement: This document grants a potential buyer the right, but not the obligation, to purchase a property within a specified time frame. Like the purchase agreement, it establishes a purchase price and conditions for the sale.

- Sales Contract: A sales contract is often used interchangeably with a Real Estate Purchase Agreement. It details the sale of real property, including price, contingencies, and closing procedures.

- Listing Agreement: This document is used between a property owner and a real estate agent. It outlines the terms under which the agent will market the property for sale, similar to how a purchase agreement outlines the terms of the sale itself.

- Joint Venture Agreement: In cases where multiple parties collaborate to purchase real estate, a joint venture agreement delineates each party's contributions and responsibilities, akin to how a purchase agreement defines roles in a transaction.

- Purchase and Sale Agreement (PSA): Often considered synonymous with a Real Estate Purchase Agreement, a PSA details the terms of the sale, including price, contingencies, and closing details, ensuring clarity for both buyer and seller.

- Employment Application: For those looking to join the workforce, the Chick Fil A Job Application form is essential. It collects key information regarding the applicant's background and availability, aiding in the recruitment process.

- Financing Agreement: This document outlines the terms of financing for a real estate transaction, much like a purchase agreement specifies the payment structure and obligations of the buyer.

- Escrow Agreement: An escrow agreement is used to manage the transfer of funds and property during a real estate transaction. It parallels a purchase agreement by ensuring that conditions are met before the transaction is finalized.

Document Example

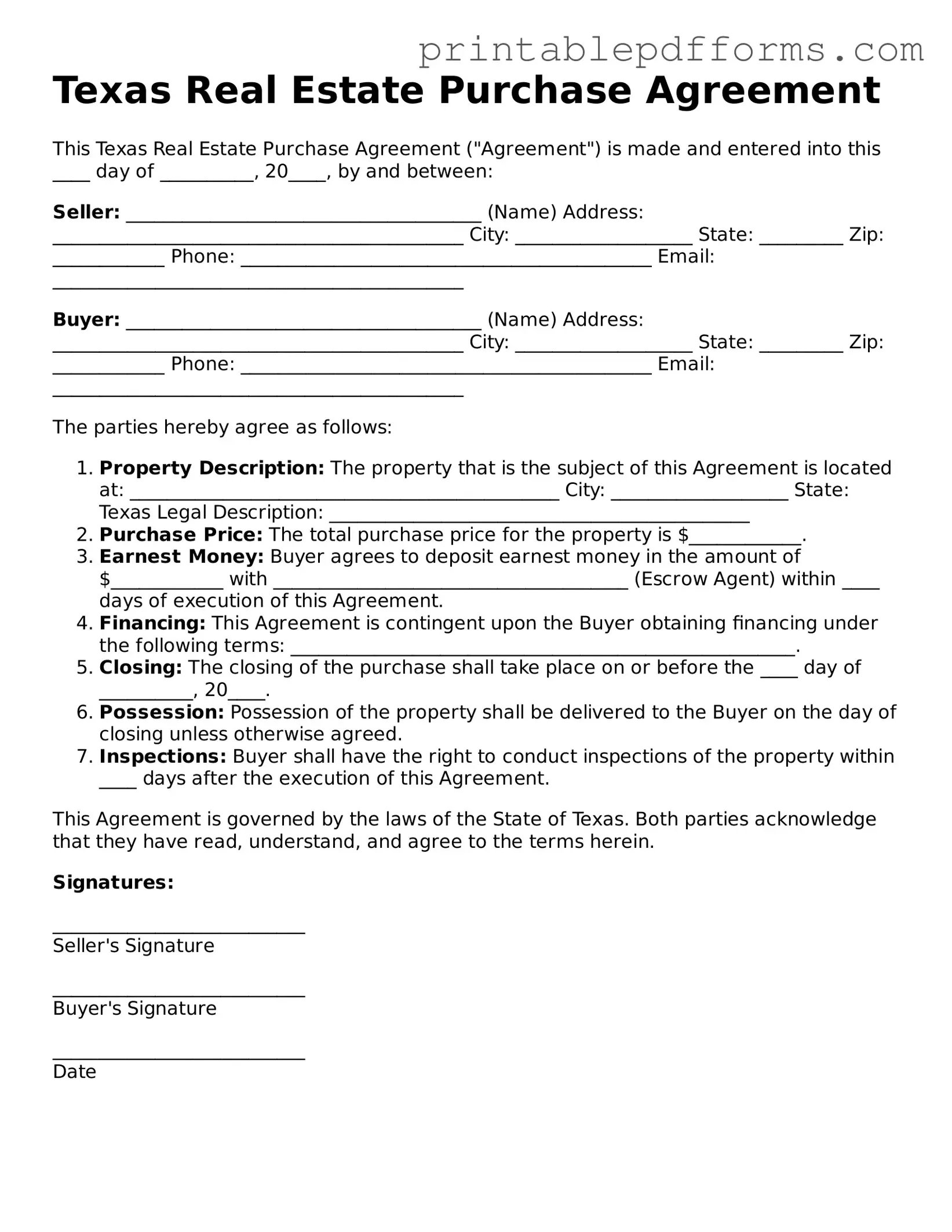

Texas Real Estate Purchase Agreement

This Texas Real Estate Purchase Agreement ("Agreement") is made and entered into this ____ day of __________, 20____, by and between:

Seller: ______________________________________ (Name) Address: ____________________________________________ City: ___________________ State: _________ Zip: ____________ Phone: ____________________________________________ Email: ____________________________________________

Buyer: ______________________________________ (Name) Address: ____________________________________________ City: ___________________ State: _________ Zip: ____________ Phone: ____________________________________________ Email: ____________________________________________

The parties hereby agree as follows:

- Property Description: The property that is the subject of this Agreement is located at: ______________________________________________ City: ___________________ State: Texas Legal Description: _____________________________________________

- Purchase Price: The total purchase price for the property is $____________.

- Earnest Money: Buyer agrees to deposit earnest money in the amount of $____________ with ______________________________________ (Escrow Agent) within ____ days of execution of this Agreement.

- Financing: This Agreement is contingent upon the Buyer obtaining financing under the following terms: ______________________________________________________.

- Closing: The closing of the purchase shall take place on or before the ____ day of __________, 20____.

- Possession: Possession of the property shall be delivered to the Buyer on the day of closing unless otherwise agreed.

- Inspections: Buyer shall have the right to conduct inspections of the property within ____ days after the execution of this Agreement.

This Agreement is governed by the laws of the State of Texas. Both parties acknowledge that they have read, understand, and agree to the terms herein.

Signatures:

___________________________

Seller's Signature

___________________________

Buyer's Signature

___________________________

Date

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Texas Real Estate Purchase Agreement is used to outline the terms of a real estate transaction between a buyer and a seller. |

| Governing Law | This agreement is governed by the laws of the State of Texas, specifically the Texas Property Code. |

| Key Components | Essential elements include the purchase price, property description, closing date, and any contingencies. |

| Signatures Required | Both the buyer and seller must sign the agreement for it to be legally binding. |

| Customizable | The form allows for customization to accommodate specific agreements between the parties involved. |

Crucial Questions on This Form

What is the Texas Real Estate Purchase Agreement?

The Texas Real Estate Purchase Agreement is a legal document used in real estate transactions to outline the terms and conditions under which a property will be sold. This agreement serves as a binding contract between the buyer and seller, detailing essential elements such as the purchase price, property description, and closing date.

Who uses the Texas Real Estate Purchase Agreement?

This agreement is utilized by various parties involved in real estate transactions, including:

- Buyers looking to purchase residential or commercial properties

- Sellers wishing to convey ownership of their property

- Real estate agents who facilitate the transaction

- Attorneys who may advise clients on the terms of the agreement

What key elements are included in the agreement?

The Texas Real Estate Purchase Agreement typically includes several important components, such as:

- Property Description: A detailed description of the property being sold, including its address and legal description.

- Purchase Price: The agreed-upon amount that the buyer will pay for the property.

- Earnest Money: A deposit made by the buyer to demonstrate serious intent to purchase.

- Closing Date: The date on which the transaction will be finalized and ownership transferred.

- Contingencies: Conditions that must be met for the sale to proceed, such as financing or inspections.

Is the Texas Real Estate Purchase Agreement legally binding?

Yes, once both parties have signed the agreement, it becomes legally binding. This means that both the buyer and seller are obligated to adhere to the terms outlined in the document. If either party fails to comply, legal action may be pursued to enforce the agreement.

Can the agreement be modified after it is signed?

Modifications can be made to the Texas Real Estate Purchase Agreement, but both parties must agree to the changes. Any amendments should be documented in writing and signed by both the buyer and seller to ensure clarity and enforceability.

What happens if the buyer backs out of the agreement?

If a buyer decides to back out of the agreement without a valid reason, they may forfeit their earnest money deposit. The seller may also have the right to pursue legal action for breach of contract, depending on the specific circumstances and terms outlined in the agreement.

Are there any standard forms for the Texas Real Estate Purchase Agreement?

Yes, the Texas Real Estate Commission provides standard forms for the Texas Real Estate Purchase Agreement. These forms are designed to ensure compliance with state laws and to protect the interests of both buyers and sellers. It is advisable to use these standardized forms to minimize potential legal issues.

Where can I obtain a Texas Real Estate Purchase Agreement?

The Texas Real Estate Purchase Agreement can be obtained from various sources, including:

- Real estate agents who can provide the form as part of their services

- The Texas Real Estate Commission's website, which offers downloadable forms

- Legal document providers that specialize in real estate transactions

Documents used along the form

When engaging in a real estate transaction in Texas, several documents accompany the Texas Real Estate Purchase Agreement to ensure a smooth process. Each of these forms serves a specific purpose and helps protect the interests of all parties involved. Below is a list of commonly used documents that you may encounter.

- Seller's Disclosure Notice: This document requires the seller to disclose any known issues or defects related to the property. It helps buyers make informed decisions and protects sellers from future liability.

- Title Commitment: Issued by a title company, this document outlines the current status of the property's title. It confirms ownership and highlights any liens or encumbrances that could affect the sale.

- Employment Verification Form: To validate employment status for rental or loan applications, utilize the necessary Employment Verification documentation to support your financial requests.

- Property Survey: A survey provides a detailed map of the property, showing boundaries, easements, and any structures. Buyers often request this to verify the size and layout of the land they are purchasing.

- Loan Application: If the buyer is financing the purchase, a loan application will be required. This document gathers financial information to help lenders assess the buyer's ability to repay the loan.

- Earnest Money Contract: This contract outlines the amount of earnest money the buyer will deposit to demonstrate their serious intent to purchase the property. It details the conditions under which the deposit is refundable.

- Closing Statement: This document summarizes the final financial details of the transaction, including costs, fees, and the distribution of funds. Both parties review this statement at closing to ensure accuracy.

- Home Warranty Agreement: This optional agreement provides coverage for certain repairs and replacements of home systems and appliances after the sale. It offers peace of mind to the buyer regarding potential future expenses.

- Deed: The deed is the legal document that transfers ownership of the property from the seller to the buyer. It must be signed and notarized to be valid and is recorded with the county for public record.

Understanding these documents is crucial for anyone involved in a real estate transaction. Each form plays a vital role in ensuring that the sale is conducted legally and fairly, safeguarding the interests of both buyers and sellers. Always consider seeking professional advice to navigate the complexities of real estate transactions effectively.

Misconceptions

When dealing with the Texas Real Estate Purchase Agreement form, several misconceptions often arise. Understanding these can help buyers and sellers navigate the real estate process more effectively.

- Misconception 1: The form is a one-size-fits-all document.

- Misconception 2: The form is only for residential transactions.

- Misconception 3: Signing the agreement means the sale is final.

- Misconception 4: You do not need legal advice to use the form.

Many people believe that the Texas Real Estate Purchase Agreement is the same for every transaction. In reality, this form can be customized to fit the specific needs of the buyer and seller. Each agreement can include unique terms and conditions based on the property and the parties involved.

Some assume that this agreement is limited to residential real estate. However, it can also be used for commercial properties. The versatility of the form allows it to accommodate various types of real estate transactions.

Many believe that once the Texas Real Estate Purchase Agreement is signed, the deal is done. This is not the case. The agreement typically includes contingencies, such as financing or inspection clauses, which allow either party to back out under certain conditions.

Some individuals think they can fill out the form without any legal guidance. While it is possible to complete the agreement on your own, seeking legal advice can help ensure that your rights are protected and that you fully understand the implications of the terms you are agreeing to.