Fill a Valid Texas residential property affidavit T-47 Form

The Texas residential property affidavit T-47 form serves as a crucial document in real estate transactions, particularly for property owners and buyers. This form is often utilized during the closing process to confirm the ownership and condition of a residential property. It includes important details such as the legal description of the property, the names of the owners, and any relevant information regarding liens or encumbrances. By signing the T-47, property owners affirm that the information provided is accurate and complete, which helps to facilitate a smooth transfer of ownership. This affidavit also plays a role in ensuring transparency in real estate dealings, as it can be used to clarify any discrepancies that may arise during the transaction. Understanding the T-47 form is essential for anyone involved in buying or selling residential property in Texas, as it helps to protect the interests of all parties involved.

Additional PDF Templates

Annual Physical Template - Your name and personal details provide your healthcare provider with necessary information for accurate treatment plans.

Completing the sale of a trailer can be a straightforward process when you have the proper documentation in place, including a California Trailer Bill of Sale. This essential form ensures that the transaction is conducted legally and provides proof of ownership for the buyer during the registration process. To ensure you have all the information you need to navigate this important step, learn more about the specifics of the California Trailer Bill of Sale.

CBP Form 6059B - The form is essential for travelers bringing in gifts, food, or alcohol above allowed limits.

Similar forms

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person. Similar to the T-47, it provides clarity regarding ownership and can help in transferring property without going through probate.

- Quitclaim Deed: A quitclaim deed transfers ownership interest in a property without guaranteeing that the title is clear. Like the T-47, it is often used to clarify property ownership among family members or in divorce settlements.

- Warranty Deed: This deed guarantees that the grantor holds clear title to the property and has the right to sell it. Both the warranty deed and T-47 help confirm ownership and protect the interests of the buyer.

- New York Motorcycle Bill of Sale: Essential for the transfer of ownership when buying or selling a motorcycle in New York State, this form includes critical details about the transaction, including buyer and seller information, motorcycle specifics, and the sale price. Proper completion and retention of this document can protect both parties during the sale process and serve as proof of purchase, similar to the documents used in property transactions. For more information, visit https://freebusinessforms.org.

- Title Insurance Policy: A title insurance policy protects buyers from potential disputes over property ownership. The T-47 form complements this by providing a sworn statement regarding the property’s status.

- Property Transfer Affidavit: This document certifies the transfer of property ownership. Similar to the T-47, it helps to clarify the details of the transaction and protect against future claims.

- Declaration of Trust: This document outlines the terms of a trust that holds property. Like the T-47, it serves to clarify ownership and the rights of beneficiaries regarding the property.

- Special Warranty Deed: This type of deed offers limited warranties regarding the title. It shares similarities with the T-47 in that both documents aim to clarify ownership and protect the interests of the parties involved.

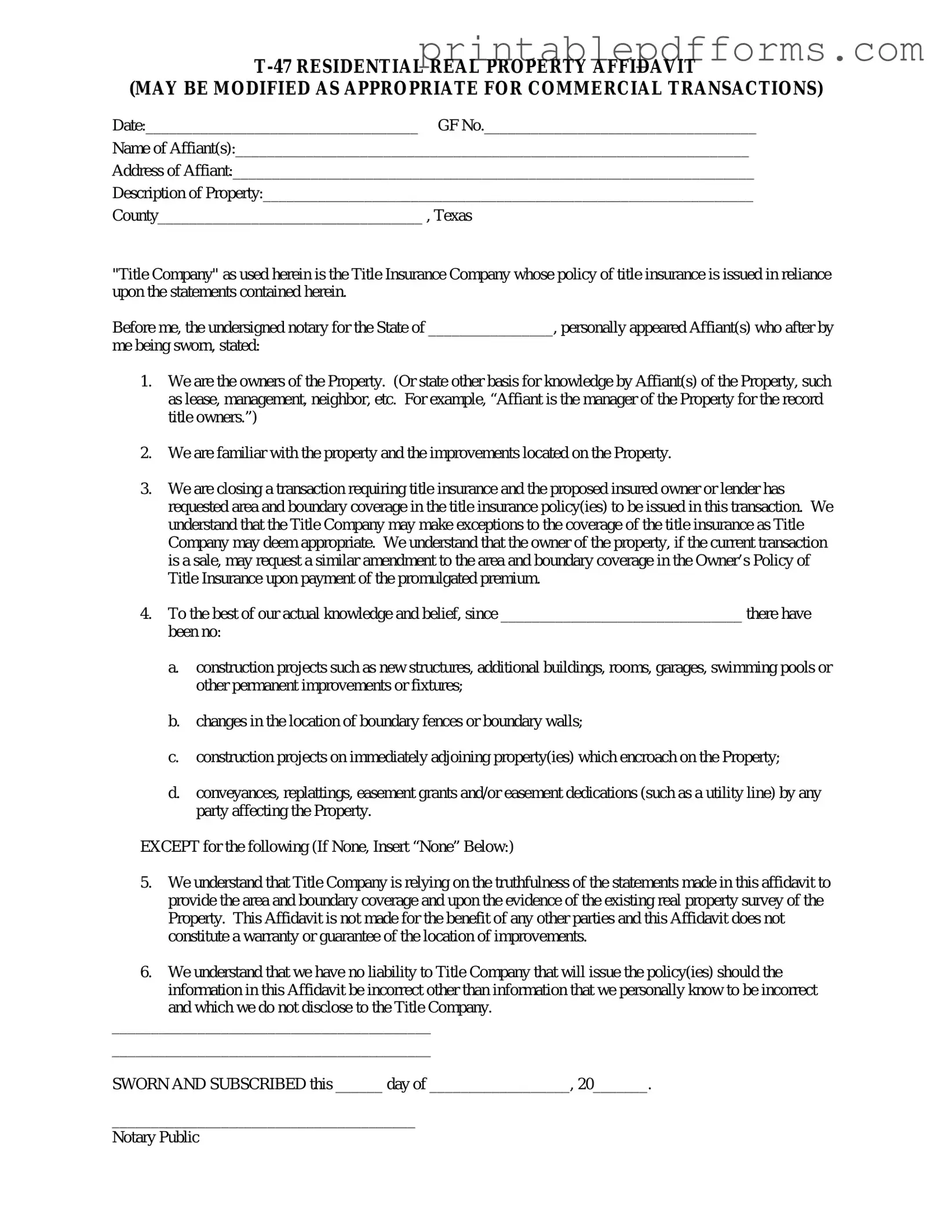

Document Example

(MAY BE MODIFIED AS APPROPRIATE FOR COMMERCIAL TRANSACTIONS)

Date:___________________________________ GF No.___________________________________

Name of Affiant(s):__________________________________________________________________

Address of Affiant:___________________________________________________________________

Description of Property:_______________________________________________________________

County__________________________________ , Texas

"Title Company" as used herein is the Title Insurance Company whose policy of title insurance is issued in reliance upon the statements contained herein.

Before me, the undersigned notary for the State of ________________, personally appeared Affiant(s) who after by

me being sworn, stated:

1.We are the owners of the Property. (Or state other basis for knowledge by Affiant(s) of the Property, such as lease, management, neighbor, etc. For example, “Affiant is the manager of the Property for the record title owners.”)

2.We are familiar with the property and the improvements located on the Property.

3.We are closing a transaction requiring title insurance and the proposed insured owner or lender has requested area and boundary coverage in the title insurance policy(ies) to be issued in this transaction. We understand that the Title Company may make exceptions to the coverage of the title insurance as Title Company may deem appropriate. We understand that the owner of the property, if the current transaction is a sale, may request a similar amendment to the area and boundary coverage in the Owner’s Policy of Title Insurance upon payment of the promulgated premium.

4.To the best of our actual knowledge and belief, since _______________________________ there have been no:

a.construction projects such as new structures, additional buildings, rooms, garages, swimming pools or other permanent improvements or fixtures;

b.changes in the location of boundary fences or boundary walls;

c.construction projects on immediately adjoining property(ies) which encroach on the Property;

d.conveyances, replattings, easement grants and/or easement dedications (such as a utility line) by any party affecting the Property.

EXCEPT for the following (If None, Insert “None” Below:)

5.We understand that Title Company is relying on the truthfulness of the statements made in this affidavit to provide the area and boundary coverage and upon the evidence of the existing real property survey of the Property. This Affidavit is not made for the benefit of any other parties and this Affidavit does not constitute a warranty or guarantee of the location of improvements.

6.We understand that we have no liability to Title Company that will issue the policy(ies) should the

information in this Affidavit be incorrect other than information that we personally know to be incorrect and which we do not disclose to the Title Company.

_________________________________________

_________________________________________

SWORN AND SUBSCRIBED this ______ day of __________________, 20_______.

_______________________________________

Notary Public

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The T-47 form is used in Texas to affirm the current ownership of residential property and to confirm the absence of certain encumbrances. |

| Governing Law | This form is governed by Texas Property Code, specifically Section 12.001 and Section 12.002. |

| Usage | It is commonly used in real estate transactions, particularly when a title company requires an affidavit of property ownership. |

| Signature Requirement | The form must be signed by the property owner in the presence of a notary public to be valid. |

| Filing | Although the T-47 form is typically not filed with the county clerk, it should be kept on file by the title company involved in the transaction. |

| Affidavit Details | The affidavit includes details about the property, such as its legal description and the owner's statement regarding the property’s status. |

| Impact on Title Insurance | Providing a T-47 can affect the issuance of title insurance, as it helps clarify any potential claims against the property. |

Crucial Questions on This Form

What is the Texas residential property affidavit T-47 form?

The Texas residential property affidavit T-47 form is a legal document used primarily in real estate transactions. It serves as a declaration made by the seller regarding the property’s condition and any encumbrances that may exist. This form is typically required by title companies to facilitate the closing process and ensure that all parties involved have a clear understanding of the property’s status.

Who needs to complete the T-47 form?

The T-47 form must be completed by the seller of the property. It is essential for individuals who are selling residential real estate in Texas. The seller is responsible for accurately disclosing any relevant information about the property, including any liens, easements, or other claims that could affect the buyer’s ownership rights.

What information is required on the T-47 form?

The T-47 form requires several pieces of information, including:

- The legal description of the property.

- The name of the seller and any co-owners.

- A statement regarding the ownership and any encumbrances on the property.

- Disclosure of any improvements or alterations made to the property.

- A certification that the information provided is accurate to the best of the seller’s knowledge.

Completing this form accurately is crucial, as any misrepresentation could lead to legal disputes down the line.

When should the T-47 form be submitted?

The T-47 form should be submitted during the closing process of the property sale. It is generally provided to the title company as part of the closing documents. Sellers are encouraged to complete the form as soon as they enter into a contract with a buyer to avoid any delays in the closing process.

What happens if the T-47 form is not completed?

If the T-47 form is not completed, it can lead to significant complications in the transaction. Title companies often require this affidavit to proceed with the closing. Without it, the buyer may face difficulties obtaining title insurance, and the closing could be delayed or even canceled. Furthermore, failing to disclose pertinent information may expose the seller to legal liability.

Can the T-47 form be amended after submission?

Documents used along the form

When dealing with real estate transactions in Texas, several forms and documents are commonly used alongside the Texas residential property affidavit T-47 form. These documents help clarify ownership, ensure proper disclosures, and facilitate smooth property transfers. Below is a list of some of these essential forms.

- Deed: This legal document officially transfers ownership of the property from the seller to the buyer. It includes details such as the names of the parties involved, a description of the property, and the signatures of those transferring the property.

- Title Commitment: This document outlines the terms under which a title insurance policy will be issued. It provides information about the current ownership of the property and any liens or encumbrances that may affect it.

- Seller's Disclosure Notice: This form requires the seller to disclose any known issues or defects with the property. It ensures that the buyer is aware of the property's condition before finalizing the purchase.

- Property Survey: A survey shows the boundaries of the property and any structures on it. This document is crucial for confirming property lines and identifying any easements or encroachments.

- Emotional Support Animal Letter - This document provides official recognition of an animal's role in supporting an individual's mental health, and you can start the process by visiting the ESA Letter site.

- Closing Statement: Also known as a HUD-1 statement, this document details all the financial aspects of the transaction. It outlines the costs involved in the sale, including closing costs, taxes, and any adjustments made between the buyer and seller.

Each of these documents plays a vital role in ensuring a clear and successful real estate transaction. Having them prepared and reviewed can help protect your interests and provide peace of mind throughout the process.

Misconceptions

The Texas residential property affidavit T-47 form is often misunderstood. Here are nine common misconceptions about this important document:

-

It is only for new homeowners.

The T-47 form is not limited to new homeowners. It can be used by anyone who is transferring property ownership, including those who have owned their property for years.

-

It is the same as a title insurance policy.

The T-47 form is not a title insurance policy. Instead, it is an affidavit that provides information about the property and its ownership, which can assist in the title insurance process.

-

It must be filed with the county clerk.

While the T-47 form is important, it does not need to be filed with the county clerk. It is typically submitted to the title company during the closing process.

-

Only one signature is required.

In many cases, multiple signatures may be necessary. All parties involved in the property transfer should sign the affidavit to ensure its validity.

-

It can be filled out after closing.

The T-47 form should be completed before closing. Doing so ensures that the title company has all necessary information to issue a title policy.

-

It is only relevant for residential properties.

The T-47 form is primarily used for residential properties, but it can also be relevant for certain types of commercial properties in specific situations.

-

It guarantees a clear title.

While the T-47 form provides important information, it does not guarantee a clear title. Title insurance is what protects against potential title issues.

-

It can be completed without any supporting documents.

Supporting documents, such as a survey or previous title policy, may be necessary to accurately complete the T-47 form. This ensures all information is correct and up-to-date.

-

It is a complicated form.

Many people find the T-47 form straightforward. With clear instructions, most individuals can complete it without needing legal assistance.

Understanding these misconceptions can help ensure a smoother property transaction process. Always consult with a real estate professional if you have questions about the T-47 form or any related documentation.