Texas Self-Proving Affidavit Document

In Texas, the Self-Proving Affidavit is a crucial tool that streamlines the probate process for wills. This form allows testators to establish the validity of their wills without requiring witnesses to appear in court. By including a Self-Proving Affidavit with a will, individuals can save their loved ones from the potential complications and delays often associated with the probate process. The form must be signed by the testator and two witnesses in the presence of a notary public, ensuring that the document is executed properly. Once completed, the affidavit serves as evidence that the will was signed voluntarily and that the testator was of sound mind at the time of signing. Utilizing this form not only enhances the efficiency of settling an estate but also provides peace of mind for both the testator and their beneficiaries, knowing that their wishes will be honored without unnecessary legal hurdles.

Discover More Self-Proving Affidavit Forms for Different States

Self Proving Will Florida - The presence of a Self-Proving Affidavit can simplify legal proceedings related to estate distribution.

In addition to ensuring a smooth transaction, utilizing the New York Motorcycle Bill of Sale form can streamline the process and provide legal protection for both the buyer and seller. It is highly recommended to download the form before initiating any sale, and you can find it at https://freebusinessforms.org/, which offers various resources for completing the sale efficiently.

Guardianship Authorization Affidavit California - The affidavit supports the idea that all legal formalities were observed when creating the will.

Will Witness Affidavit - When organizing an estate plan, consider the advantages of this affidavit.

Similar forms

- Last Will and Testament: This document outlines a person's wishes regarding the distribution of their property after death. Like a Self-Proving Affidavit, it serves to validate intentions and can simplify the probate process.

- Durable Power of Attorney: A Durable Power of Attorney allows someone to make decisions on behalf of another person. Similar to a Self-Proving Affidavit, it provides assurance that the appointed individual can act in the best interest of the person who created the document.

- Living Will: This document expresses a person's healthcare preferences in case they become unable to communicate. Both documents affirm an individual's wishes and can ease decision-making for loved ones.

- Health Care Proxy: A Health Care Proxy designates someone to make medical decisions for another. Like a Self-Proving Affidavit, it confirms the authority of the designated person and ensures that medical preferences are honored.

- Trust Agreement: A Trust Agreement outlines how assets will be managed and distributed. Similar to a Self-Proving Affidavit, it can streamline the process of asset transfer and provide clarity to beneficiaries.

- Affidavit of Heirship: This document establishes the heirs of a deceased person. Like a Self-Proving Affidavit, it serves to confirm relationships and can facilitate the transfer of property without formal probate.

- Tractor Bill of Sale: This form is essential for recording the transfer of ownership of a tractor in Georgia. To learn more about it and facilitate your purchase or sale, visit georgiapdf.com/tractor-bill-of-sale/.

- Quitclaim Deed: A Quitclaim Deed transfers ownership of property without guaranteeing that the title is clear. It shares similarities with a Self-Proving Affidavit in that both documents aim to clarify intentions and facilitate property transactions.

- Declaration of Trust: This document outlines the terms of a trust and the duties of the trustee. Like a Self-Proving Affidavit, it provides legal recognition of the trust's existence and can help manage assets efficiently.

- Marital Settlement Agreement: This agreement outlines the terms of a divorce, including asset division and child custody. Similar to a Self-Proving Affidavit, it formalizes decisions made by both parties, reducing future disputes.

- Guardianship Agreement: This document appoints a guardian for a minor or incapacitated person. Like a Self-Proving Affidavit, it ensures that the chosen guardian has legal authority and can act in the best interests of the individual.

Document Example

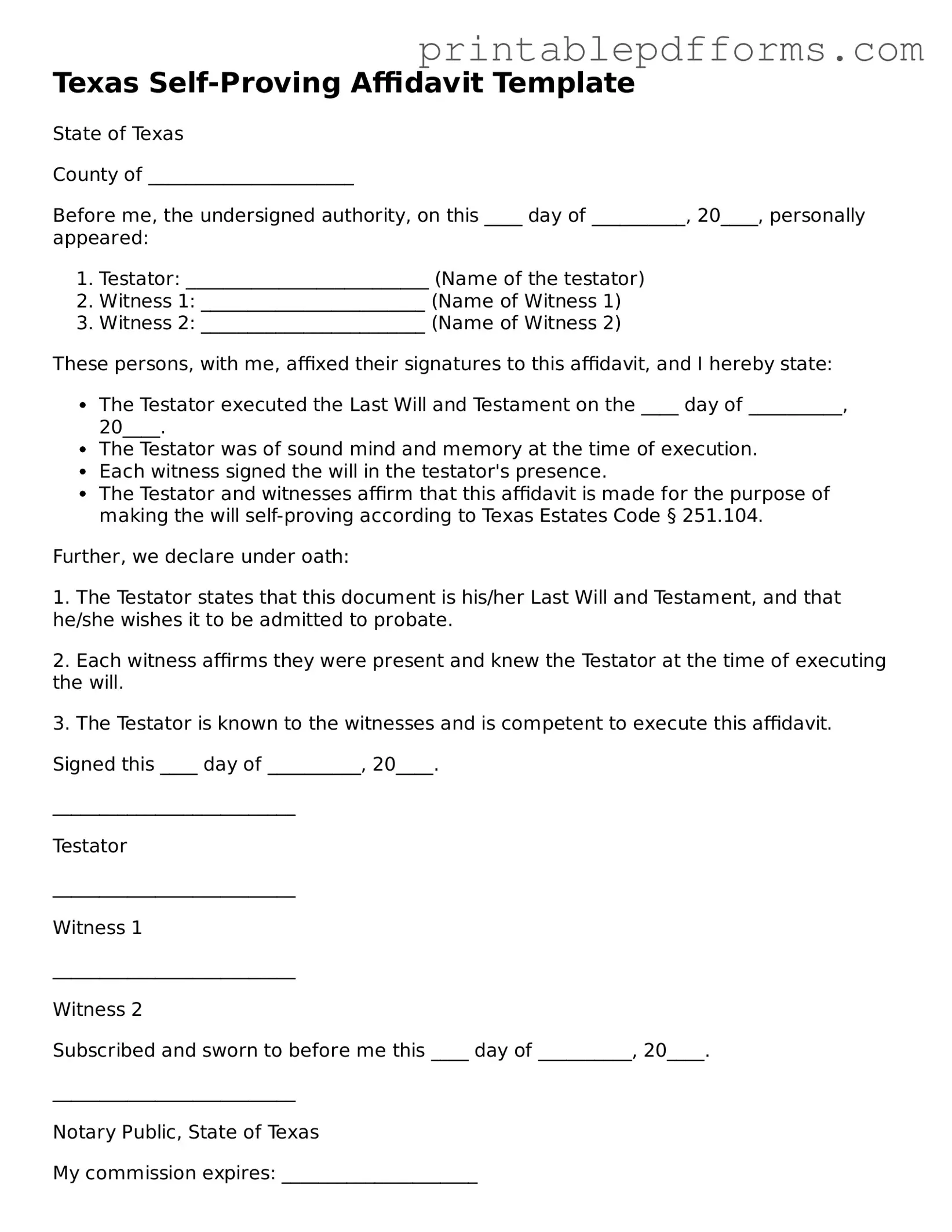

Texas Self-Proving Affidavit Template

State of Texas

County of ______________________

Before me, the undersigned authority, on this ____ day of __________, 20____, personally appeared:

- Testator: __________________________ (Name of the testator)

- Witness 1: ________________________ (Name of Witness 1)

- Witness 2: ________________________ (Name of Witness 2)

These persons, with me, affixed their signatures to this affidavit, and I hereby state:

- The Testator executed the Last Will and Testament on the ____ day of __________, 20____.

- The Testator was of sound mind and memory at the time of execution.

- Each witness signed the will in the testator's presence.

- The Testator and witnesses affirm that this affidavit is made for the purpose of making the will self-proving according to Texas Estates Code § 251.104.

Further, we declare under oath:

1. The Testator states that this document is his/her Last Will and Testament, and that he/she wishes it to be admitted to probate.

2. Each witness affirms they were present and knew the Testator at the time of executing the will.

3. The Testator is known to the witnesses and is competent to execute this affidavit.

Signed this ____ day of __________, 20____.

__________________________

Testator

__________________________

Witness 1

__________________________

Witness 2

Subscribed and sworn to before me this ____ day of __________, 20____.

__________________________

Notary Public, State of Texas

My commission expires: _____________________

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | A Texas Self-Proving Affidavit is a legal document that allows a will to be validated without the need for witnesses to testify in court. |

| Governing Law | The Texas Self-Proving Affidavit is governed by Texas Estates Code, Section 251.104. |

| Purpose | This affidavit simplifies the probate process by providing proof that the will was properly executed. |

| Requirements | The testator and witnesses must sign the affidavit in front of a notary public. |

| Form Usage | It is typically used alongside a will to ensure that the will can be accepted by the court without additional witness testimony. |

| Validity | The affidavit remains valid as long as the will it accompanies is valid and has not been revoked. |

| Execution | To execute a self-proving affidavit, all parties must be present and willing to affirm the authenticity of the will. |

Crucial Questions on This Form

What is a Texas Self-Proving Affidavit?

A Texas Self-Proving Affidavit is a legal document that allows a will to be validated without the need for witnesses to testify in court. This affidavit is typically signed by the testator (the person making the will) and witnesses at the same time the will is executed. It simplifies the probate process by providing proof that the will was created in accordance with Texas law.

Why should I use a Self-Proving Affidavit?

Using a Self-Proving Affidavit can save time and reduce complications during the probate process. When a will includes this affidavit, the court can accept it without requiring witnesses to appear. This is especially beneficial if witnesses are unavailable or cannot be located after the testator's death.

Who can sign the Self-Proving Affidavit?

The Self-Proving Affidavit must be signed by the testator and at least two witnesses. These witnesses should not be beneficiaries of the will to avoid any potential conflicts of interest. It is essential that all parties are present when the affidavit is signed to ensure its validity.

How do I create a Self-Proving Affidavit?

To create a Self-Proving Affidavit in Texas, follow these steps:

- Prepare your will, ensuring it meets all legal requirements.

- Draft the Self-Proving Affidavit, including necessary information such as the names and addresses of the testator and witnesses.

- Have the testator and witnesses sign the affidavit in the presence of each other.

- Consider having the affidavit notarized to add an extra layer of authenticity.

Can I revoke a Self-Proving Affidavit?

Yes, a Self-Proving Affidavit can be revoked if the testator decides to change their will or if they create a new will that does not include the affidavit. It is important to properly document any changes to ensure that the most current wishes of the testator are honored.

Where should I keep my Self-Proving Affidavit?

It is advisable to keep the Self-Proving Affidavit with the original will in a safe place. Inform trusted family members or your attorney about its location. This ensures that the document can be easily accessed when needed during the probate process.

Documents used along the form

The Texas Self-Proving Affidavit is a valuable document that simplifies the probate process by allowing a will to be accepted without the need for witnesses to testify about its validity. However, it is often used in conjunction with other important forms and documents that help ensure a comprehensive estate plan. Below is a list of documents commonly associated with the Self-Proving Affidavit in Texas.

- Last Will and Testament: This is the primary document that outlines how a person's assets and affairs should be handled after their death. It specifies beneficiaries and may include instructions for guardianship of minors.

- Vehicle Bill of Sale: This document is essential for the sale of a vehicle as it ties both parties into a legal agreement. For those in Ohio, you can find the necessary form at All Ohio Forms.

- Durable Power of Attorney: This document grants someone the authority to make financial and legal decisions on behalf of another person if they become incapacitated.

- Medical Power of Attorney: This form allows an individual to designate someone to make healthcare decisions on their behalf if they are unable to do so themselves.

- Living Will: A living will outlines a person's wishes regarding medical treatment and end-of-life care, particularly in situations where they cannot communicate their preferences.

- Declaration of Guardian: This document allows an individual to name a guardian for themselves or their minor children in the event of incapacity or death.

- Trust Documents: These documents establish a trust, which can manage assets for beneficiaries, often providing tax benefits and avoiding probate.

- Affidavit of Heirship: This form is used to establish the heirs of a deceased person when there is no will, helping to clarify ownership of property.

- Inventory of Assets: This document lists all assets owned by the deceased, providing a clear overview for the probate process and for beneficiaries.

- Notice of Probate: This is a formal notification to interested parties that a will has been submitted for probate, ensuring that all relevant individuals are informed.

Utilizing these documents alongside the Texas Self-Proving Affidavit can help streamline the estate planning and probate processes. Each document plays a crucial role in ensuring that a person's wishes are honored and that their affairs are managed according to their preferences.

Misconceptions

When it comes to the Texas Self-Proving Affidavit, many people hold misconceptions that can lead to confusion. Here are five common misunderstandings about this important legal document:

-

It is only necessary for wills.

While the Self-Proving Affidavit is often associated with wills, it can also be used for other legal documents. Any instrument that requires notarization can benefit from this affidavit, making it a versatile tool in estate planning.

-

It eliminates the need for witnesses.

This is not entirely accurate. While the Self-Proving Affidavit allows a will to be accepted without the witnesses having to testify in court, the presence of witnesses during the signing of the will is still essential for validity.

-

It must be filed with the court immediately.

Many believe that the Self-Proving Affidavit must be filed right away. In reality, it can be presented alongside the will during probate proceedings, so there is no rush to file it separately.

-

It can be created at any time.

Some think they can draft a Self-Proving Affidavit whenever they wish. However, it must be executed at the same time as the will to ensure its effectiveness. Timing matters in this process.

-

It guarantees that the will cannot be contested.

While the Self-Proving Affidavit does streamline the probate process, it does not offer immunity against challenges. Heirs or interested parties can still contest the will based on other grounds.

Understanding these misconceptions can help individuals navigate the complexities of estate planning more effectively. Always consult with a knowledgeable professional when dealing with legal documents to ensure compliance and clarity.