Texas Transfer-on-Death Deed Document

In Texas, the Transfer-on-Death Deed (TODD) serves as a valuable tool for property owners who wish to ensure a smooth transition of their real estate assets upon their passing. This form allows individuals to designate one or more beneficiaries who will automatically inherit their property without the need for probate. By using the TODD, property owners can maintain full control over their assets during their lifetime, while also providing a clear and straightforward plan for the future. The form must be properly executed and recorded to be effective, ensuring that the transfer of ownership occurs seamlessly after the owner's death. Additionally, it is important to note that the TODD can be revoked or modified at any time, offering flexibility to adapt to changing circumstances. Understanding the implications and requirements of this deed can empower property owners to make informed decisions about their estate planning, ultimately providing peace of mind for themselves and their loved ones.

Discover More Transfer-on-Death Deed Forms for Different States

Where Can I Get a Tod Form - Using this deed helps to avoid potential disputes among heirs by clearly outlining your wishes ahead of time.

For those considering their estate planning options, a carefully structured Last Will and Testament can provide clarity regarding asset distribution. This document not only reflects your wishes but also serves to facilitate a smoother transition for your loved ones. You can find a practical template for creating your own Last Will and Testament document that meets Ohio’s legal requirements.

Transfer on Death Deed Florida Form - Many people opt for this deed for its ease and efficiency in estate planning.

Transfer on Death Deed Ohio Pdf - Some jurisdictions may have specific requirements for the deed to be valid, including witness signatures.

Similar forms

The Transfer-on-Death Deed form is a useful legal tool for estate planning. It allows individuals to designate beneficiaries who will receive property upon the owner's death, without going through probate. Several other documents serve similar purposes or share characteristics with the Transfer-on-Death Deed. Here are six such documents:

- Will: A will outlines how a person's assets will be distributed after their death. Like the Transfer-on-Death Deed, it allows for the designation of beneficiaries, but it requires probate to execute the distribution of assets.

- Living Trust: A living trust holds assets during a person's lifetime and specifies how they should be distributed after death. It avoids probate, similar to the Transfer-on-Death Deed, and offers more control over asset management.

- Payable-on-Death (POD) Accounts: These accounts allow individuals to name beneficiaries who will receive funds directly upon the account holder's death. This process bypasses probate, akin to how a Transfer-on-Death Deed works for real property.

- Operating Agreement: The operating agreement serves as a foundational document for LLCs, outlining management and operational guidelines. It establishes member roles and financial responsibilities, ensuring smooth business operation. For more information, visit All Ohio Forms.

- Joint Tenancy with Right of Survivorship: This property ownership method allows co-owners to inherit the property automatically when one owner passes away. It provides a direct transfer of ownership similar to the Transfer-on-Death Deed.

- Beneficiary Designations: Commonly used for retirement accounts and life insurance policies, these designations specify who will receive the assets upon the owner's death. This process is straightforward and avoids probate, much like the Transfer-on-Death Deed.

- Life Estate Deed: A life estate deed allows a person to retain the right to use and benefit from a property during their lifetime, with the property passing to a designated beneficiary upon their death. This ensures a direct transfer of ownership, similar to the Transfer-on-Death Deed.

Understanding these documents can help individuals make informed decisions about their estate planning needs, ensuring that their wishes are honored and their loved ones are taken care of.

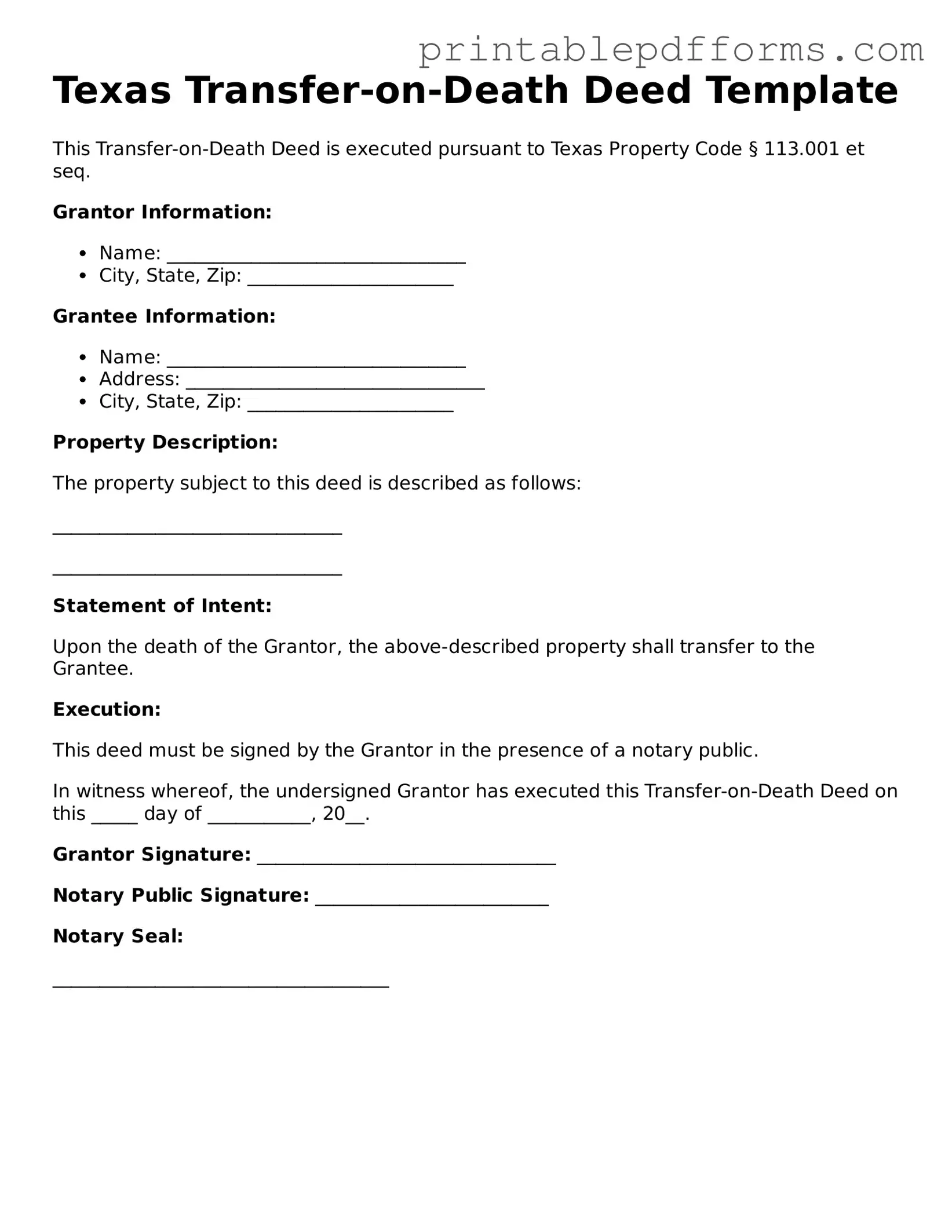

Document Example

Texas Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed pursuant to Texas Property Code § 113.001 et seq.

Grantor Information:

- Name: ________________________________

- City, State, Zip: ______________________

Grantee Information:

- Name: ________________________________

- Address: ________________________________

- City, State, Zip: ______________________

Property Description:

The property subject to this deed is described as follows:

_______________________________

_______________________________

Statement of Intent:

Upon the death of the Grantor, the above-described property shall transfer to the Grantee.

Execution:

This deed must be signed by the Grantor in the presence of a notary public.

In witness whereof, the undersigned Grantor has executed this Transfer-on-Death Deed on this _____ day of ___________, 20__.

Grantor Signature: ________________________________

Notary Public Signature: _________________________

Notary Seal:

____________________________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Texas to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Texas Transfer-on-Death Deed is governed by Section 114.001 of the Texas Estates Code. |

| Eligibility | Any individual who owns real estate in Texas can create a Transfer-on-Death Deed to designate beneficiaries. |

| Revocation | The deed can be revoked or changed at any time before the property owner's death, provided the proper procedures are followed. |

| Filing Requirements | The deed must be recorded in the county where the property is located to be effective. |

| Beneficiary Rights | Beneficiaries do not have any rights to the property until the owner's death, ensuring the owner retains full control during their lifetime. |

| Tax Implications | Transferring property via a Transfer-on-Death Deed generally does not trigger gift taxes, as the transfer occurs at death. |

Crucial Questions on This Form

What is a Texas Transfer-on-Death Deed?

A Texas Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners to designate beneficiaries who will receive their real estate upon their death. This deed enables individuals to transfer property without going through probate, making the process simpler and often quicker for heirs.

Who can use a Transfer-on-Death Deed in Texas?

Any individual who owns real property in Texas can utilize a Transfer-on-Death Deed. This includes single owners, married couples, and even individuals who own property as part of a business. However, it’s important to ensure that the deed is executed correctly to be valid.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, follow these general steps:

- Obtain a blank Transfer-on-Death Deed form. These forms are available online or at legal stationery stores.

- Fill out the form with the necessary information, including the property description and the names of the beneficiaries.

- Sign the deed in the presence of a notary public.

- Record the deed with the county clerk’s office in the county where the property is located.

It is advisable to consult with a legal professional to ensure that the deed is properly executed and recorded.

Can I change or revoke a Transfer-on-Death Deed after it is created?

Yes, you can change or revoke a Transfer-on-Death Deed at any time while you are alive. To do this, you need to create a new deed that either changes the beneficiaries or explicitly revokes the previous deed. This new deed must also be signed and recorded to be effective.

What happens if I do not name a beneficiary in my Transfer-on-Death Deed?

If no beneficiary is named in the Transfer-on-Death Deed, the property will become part of your estate upon your death. This means it will be subject to the probate process, which can be time-consuming and costly for your heirs.

Are there any limitations to using a Transfer-on-Death Deed?

Yes, there are some limitations to consider:

- The Transfer-on-Death Deed can only be used for real property, not personal property or financial accounts.

- It does not affect any existing liens or debts on the property. Beneficiaries may still be responsible for these obligations.

- It may not be suitable for complex estate planning needs, so consulting with a legal professional is recommended for such cases.

Documents used along the form

The Texas Transfer-on-Death Deed (TODD) is a legal document that allows property owners to designate beneficiaries who will receive the property upon the owner's death, bypassing probate. Alongside the TODD, several other forms and documents may be necessary to ensure proper estate planning and property transfer. Below is a list of commonly used documents that complement the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how a person's assets should be distributed after their death. It can specify guardianship for minor children and address other estate matters not covered by the TODD.

- Durable Power of Attorney: This form allows an individual to appoint someone to make financial and legal decisions on their behalf if they become incapacitated.

- Medical Power of Attorney: This document designates an individual to make healthcare decisions for a person who is unable to do so due to illness or incapacity.

- Boat Bill of Sale: This document is essential for transferring ownership of a boat, ensuring that all necessary details, such as buyer and seller information, are recorded properly. For more information, visit https://nypdfforms.com/boat-bill-of-sale-form/.

- Living Will: A living will provides instructions regarding a person's preferences for medical treatment and end-of-life care, guiding healthcare providers and loved ones.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person when there is no will. It can help clarify ownership of property after death.

- Deed of Trust: This document secures a loan by transferring property to a trustee, who holds it until the borrower repays the loan. It is often used in real estate transactions.

- Quitclaim Deed: This deed transfers whatever interest the grantor has in the property without guaranteeing that the title is clear. It is often used between family members or in divorce settlements.

- Property Tax Exemption Application: This form allows property owners to apply for exemptions that can reduce their property tax burden, such as homestead exemptions.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for financial accounts, insurance policies, and retirement plans, ensuring that these assets transfer directly to the named individuals.

Each of these documents plays a crucial role in comprehensive estate planning. Together with the Texas Transfer-on-Death Deed, they help ensure that an individual's wishes are respected and that their assets are distributed according to their desires after their passing.

Misconceptions

Understanding the Texas Transfer-on-Death Deed form is crucial for effective estate planning. However, several misconceptions can lead to confusion and potential issues. Here are six common misconceptions:

- It is only for wealthy individuals. Many believe that Transfer-on-Death Deeds are only beneficial for those with significant assets. In reality, this deed can be useful for anyone wanting to simplify the transfer of property upon death, regardless of their financial status.

- It automatically transfers all property. Some assume that a Transfer-on-Death Deed will cover all types of property. However, it specifically applies only to real estate and does not extend to personal property, bank accounts, or other assets.

- It requires probate. A common myth is that a Transfer-on-Death Deed still necessitates going through the probate process. This is incorrect; properties transferred via this deed typically bypass probate, allowing for a smoother transition.

- It cannot be revoked or changed. Many think once a Transfer-on-Death Deed is filed, it is set in stone. In fact, property owners can revoke or amend the deed at any time, as long as they follow the proper legal procedures.

- It affects property ownership during the owner's lifetime. Some people worry that signing a Transfer-on-Death Deed will alter their ownership rights while they are alive. This is a misconception; the owner retains full control over the property until their death.

- All family members must agree to the deed. There is a belief that all heirs must consent to the Transfer-on-Death Deed. However, the property owner can make this decision independently, without needing approval from family members.

Clarifying these misconceptions is essential for effective estate planning. Understanding the true nature of the Texas Transfer-on-Death Deed can help individuals make informed decisions about their property and ensure a smoother transition for their heirs.