Blank Transfer-on-Death Deed Form

Planning for the future can often feel overwhelming, especially when it comes to managing assets and ensuring they are passed on to loved ones. One effective tool that has gained attention in estate planning is the Transfer-on-Death (TOD) Deed. This legal document allows property owners to designate beneficiaries who will automatically receive the property upon the owner's death, thus bypassing the often lengthy and costly probate process. The TOD Deed is particularly appealing because it remains revocable during the owner’s lifetime, offering flexibility and control. It can apply to various types of real estate, including residential homes and vacant land, making it a versatile option for many. However, it’s essential to understand the specific requirements for executing a TOD Deed, as well as the implications it carries for both the owner and the beneficiaries. With the right knowledge, individuals can utilize this form to simplify the transfer of their property and ensure their wishes are honored after they are gone.

State-specific Guidelines for Transfer-on-Death Deed Forms

Popular Transfer-on-Death Deed Documents:

Lady Bird Deed Michigan Form - Trustees can also use this deed for good estate management.

For more information about the details and guidelines related to the WC-1 Georgia form, you can visit https://georgiapdf.com/wc-1-georgia, where you will find valuable resources to assist you in the completion of this essential document.

Quit Claim Deed Form Iowa - In cases of real estate foreclosures, a Quitclaim Deed may be used to transfer ownership to creditors.

Similar forms

- Will: A will specifies how a person's assets will be distributed after their death. Like a Transfer-on-Death Deed, it allows individuals to express their wishes regarding property transfer, but it goes into effect only after probate.

- Living Trust: A living trust holds assets during a person's lifetime and specifies how they should be distributed upon death. Both documents facilitate the transfer of property outside of probate, but a trust requires more management during the grantor's life.

- Beneficiary Designation: Commonly used for bank accounts and retirement plans, this document allows individuals to name beneficiaries who will receive assets upon death. Similar to a Transfer-on-Death Deed, it bypasses probate for the designated assets.

- Non-disclosure Agreement: An Ohio Non-disclosure Agreement form is essential for protecting sensitive information and plays a vital role in various professional contexts. For more details, visit All Ohio Forms.

- Joint Tenancy: In a joint tenancy arrangement, property is owned by two or more individuals with rights of survivorship. When one owner dies, the property automatically passes to the surviving owner, akin to the transfer mechanism of a Transfer-on-Death Deed.

- Payable-on-Death Account: This type of bank account allows the account holder to name a beneficiary who will receive the funds upon the holder's death. Like a Transfer-on-Death Deed, it avoids probate and directly transfers assets.

- Life Estate Deed: A life estate deed allows a person to retain the right to use property during their lifetime while transferring ownership to another party upon death. Both documents facilitate a transfer of property, but a life estate deed involves retained rights.

- Transfer-on-Death Registration: This is used for certain types of securities and allows the owner to designate a beneficiary who will receive the assets upon death. Similar to a Transfer-on-Death Deed, it enables a straightforward transfer without probate.

Document Example

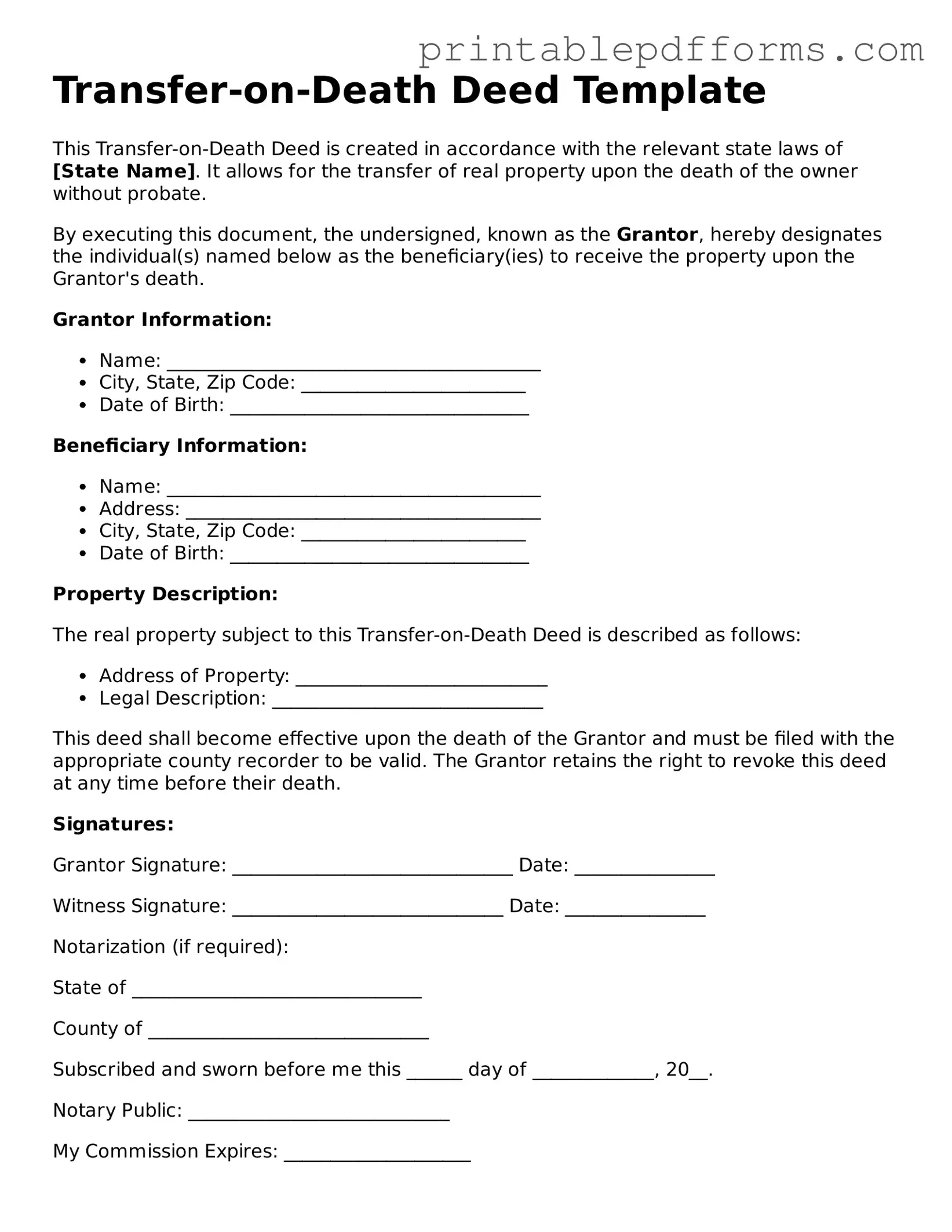

Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created in accordance with the relevant state laws of [State Name]. It allows for the transfer of real property upon the death of the owner without probate.

By executing this document, the undersigned, known as the Grantor, hereby designates the individual(s) named below as the beneficiary(ies) to receive the property upon the Grantor's death.

Grantor Information:

- Name: ________________________________________

- City, State, Zip Code: ________________________

- Date of Birth: ________________________________

Beneficiary Information:

- Name: ________________________________________

- Address: ______________________________________

- City, State, Zip Code: ________________________

- Date of Birth: ________________________________

Property Description:

The real property subject to this Transfer-on-Death Deed is described as follows:

- Address of Property: ___________________________

- Legal Description: _____________________________

This deed shall become effective upon the death of the Grantor and must be filed with the appropriate county recorder to be valid. The Grantor retains the right to revoke this deed at any time before their death.

Signatures:

Grantor Signature: ______________________________ Date: _______________

Witness Signature: _____________________________ Date: _______________

Notarization (if required):

State of _______________________________

County of ______________________________

Subscribed and sworn before me this ______ day of _____________, 20__.

Notary Public: ____________________________

My Commission Expires: ____________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by state laws, which vary by state. For example, in California, it is governed by California Probate Code Section 5600. |

| Beneficiary Designation | Property owners can name one or more beneficiaries in the deed, allowing them to specify who will receive the property. |

| Revocation | The deed can be revoked or changed by the property owner at any time before their death, ensuring flexibility. |

| Tax Implications | Transfer-on-Death Deeds do not trigger gift taxes during the owner's lifetime, as ownership remains with the grantor until death. |

| Real Estate Only | This deed applies only to real estate and cannot be used for personal property or bank accounts. |

| Execution Requirements | To be valid, the deed must be signed and notarized, and it must be recorded with the appropriate county office. |

| Effect on Creditors | Property transferred via a Transfer-on-Death Deed may still be subject to the deceased's creditors' claims, depending on state law. |

| State Availability | Not all states recognize Transfer-on-Death Deeds. It is essential to check local laws to determine if this option is available. |

Crucial Questions on This Form

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows a property owner to designate one or more beneficiaries to receive their real estate upon their death. This type of deed avoids the probate process, meaning the property can transfer directly to the beneficiary without court involvement.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate can use a Transfer-on-Death Deed. This includes homeowners, co-owners, and individuals holding property in trust. However, the specific rules can vary by state, so it’s important to check local laws.

How does a Transfer-on-Death Deed work?

When the property owner passes away, the designated beneficiary automatically receives the title to the property. The beneficiary must file the TOD Deed with the local recorder’s office before the owner’s death to ensure the transfer is valid. The deed must also be signed and notarized.

What are the benefits of using a Transfer-on-Death Deed?

- Avoids probate: The property transfers directly to the beneficiary, saving time and money.

- Retains control: The property owner maintains full control over the property during their lifetime.

- Flexibility: The owner can revoke or change the deed at any time before their death.

Are there any downsides to a Transfer-on-Death Deed?

While there are many advantages, there are also potential downsides. For example, if the property owner has debts or liens, creditors may still claim the property after death. Additionally, if the beneficiary is not capable of managing the property, it could lead to complications.

Can a Transfer-on-Death Deed be revoked?

Yes, a Transfer-on-Death Deed can be revoked. The property owner can do this by creating a new deed that explicitly revokes the previous one or by executing a revocation document. It’s important to file the revocation with the local recorder’s office to ensure it is recognized.

What happens if the beneficiary predeceases the property owner?

If the designated beneficiary dies before the property owner, the transfer will not occur. The property owner should consider naming alternate beneficiaries to ensure the property is still transferred as intended.

Is legal advice recommended when creating a Transfer-on-Death Deed?

While it is possible to create a Transfer-on-Death Deed without legal assistance, consulting with an attorney is advisable. They can provide guidance on state-specific requirements and help ensure the deed is properly executed and meets the property owner's wishes.

Documents used along the form

A Transfer-on-Death Deed (TOD) is a useful tool for individuals looking to pass their property to beneficiaries without going through probate. However, several other forms and documents are often used alongside the TOD to ensure a smooth transfer of assets. Here are some commonly associated documents:

- Will: A legal document that outlines how a person's assets should be distributed after their death. It can include specific bequests and appoint an executor to manage the estate.

- Living Trust: A trust created during a person's lifetime that allows them to manage their assets while they are alive and distribute them after death without going through probate.

- Beneficiary Designation Forms: These forms specify who will receive certain assets, such as bank accounts or retirement plans, upon the account holder's death. They override any conflicting instructions in a will.

- Power of Attorney: A document that grants someone the authority to make financial or medical decisions on behalf of another person if they become incapacitated.

- Affidavit of Heirship: A sworn statement used to establish the heirs of a deceased person, particularly when there is no will or formal probate process.

- Recommendation Letter Form: This form serves as a vital instrument for obtaining endorsements from peers and mentors, allowing for an insightful portrayal of an individual's skills and character. For more information, visit freebusinessforms.org/.

- Property Deed: The legal document that transfers ownership of real estate. It may need to be updated or recorded to reflect the changes made by the TOD.

These documents can work together to create a comprehensive estate plan. Understanding each of them is crucial for effective asset management and ensuring that your wishes are honored after your passing.

Misconceptions

Understanding the Transfer-on-Death Deed can be challenging due to various misconceptions. Here are ten common misunderstandings about this form:

- It is the same as a will. A Transfer-on-Death Deed is not a will. It allows for the direct transfer of property upon death, bypassing probate, while a will goes through the probate process.

- It is only for real estate. While primarily used for real estate, it can also apply to certain types of property, depending on state laws.

- It requires the consent of all beneficiaries. The property owner does not need to obtain consent from beneficiaries to create or revoke a Transfer-on-Death Deed.

- It cannot be revoked. A Transfer-on-Death Deed can be revoked or changed at any time before the owner’s death, as long as the proper procedure is followed.

- It automatically transfers all debts. The deed transfers ownership of the property, but it does not transfer debts associated with that property. Beneficiaries may still need to address any outstanding debts.

- It is a complicated process. The process of creating a Transfer-on-Death Deed is generally straightforward and can often be completed without legal assistance.

- It is only valid in certain states. While not all states recognize Transfer-on-Death Deeds, many do, and the rules can vary significantly. It is essential to check local laws.

- It has no tax implications. Beneficiaries may still face tax implications upon inheriting property, so it is important to consult a tax professional.

- It is only for single individuals. Married couples can also use a Transfer-on-Death Deed to designate beneficiaries for their jointly owned property.

- It guarantees the property will go to the named beneficiary. While the deed names beneficiaries, it does not guarantee transfer if the beneficiary predeceases the owner or if certain conditions are not met.

Being aware of these misconceptions can help individuals make informed decisions regarding estate planning and property transfer.