Blank Vehicle Repayment Agreement Form

The Vehicle Repayment Agreement form plays a crucial role in the financial landscape for individuals and businesses alike. It serves as a binding document that outlines the terms and conditions under which a borrower agrees to repay a loan taken out for purchasing a vehicle. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any applicable fees. Additionally, it highlights the responsibilities of both the borrower and the lender, ensuring that all parties are clear on their obligations. By clearly delineating these terms, the form not only protects the lender's investment but also provides the borrower with a structured plan for repayment, fostering transparency and accountability. Understanding the nuances of this agreement can empower borrowers to make informed decisions, ultimately leading to a smoother financial journey.

Other Templates:

Waiver and Release of Liability - A risk acknowledgment form that participants sign before engaging in certain activities.

In addition to understanding the details of the Ohio Traffic Crash Report form, it is crucial for individuals involved in traffic incidents to familiarize themselves with the necessary documentation resources available, such as All Ohio Forms, which provide easy access to various legal and procedural forms relevant to traffic accidents in the state.

262 Form - Section 1 requires a detailed description of the vehicle or vessel, essential for identification.

Similar forms

- Loan Agreement: This document outlines the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. Like the Vehicle Repayment Agreement, it establishes the obligations of both parties regarding payment.

- Lease Agreement: A lease agreement specifies the terms under which one party rents property from another. Similar to the Vehicle Repayment Agreement, it details payment amounts and schedules, along with responsibilities for maintenance.

- Promissory Note: This document serves as a written promise to pay a specified amount to a lender. It shares similarities with the Vehicle Repayment Agreement in that it clearly states repayment terms and conditions.

- Sales Contract: A sales contract outlines the terms of a sale, including price and payment methods. Like the Vehicle Repayment Agreement, it ensures both parties understand their rights and obligations regarding the transaction.

- Mortgage Agreement: This document is used when securing a loan with real property. It is similar in structure to the Vehicle Repayment Agreement, as both include details on repayment terms and consequences for default.

- Credit Card Agreement: This document outlines the terms of credit card use, including interest rates and payment schedules. It shares the same purpose of defining repayment obligations as the Vehicle Repayment Agreement.

- Service Agreement: A service agreement details the terms of a service provided, including payment details. Like the Vehicle Repayment Agreement, it clarifies what is expected from both parties.

- Investment Letter of Intent: To initiate investment discussions, consider using our essential Investment Letter of Intent template to outline preliminary terms and agreements.

- Installment Agreement: This document allows for payment in installments over time. It is similar to the Vehicle Repayment Agreement as both specify how and when payments should be made.

- Debt Settlement Agreement: This document outlines the terms for settling a debt for less than the full amount owed. Like the Vehicle Repayment Agreement, it involves negotiations and specifies payment terms.

- Personal Loan Agreement: This document details the terms of a personal loan, including repayment schedule and interest rates. It resembles the Vehicle Repayment Agreement in that it establishes a clear framework for repayment.

Document Example

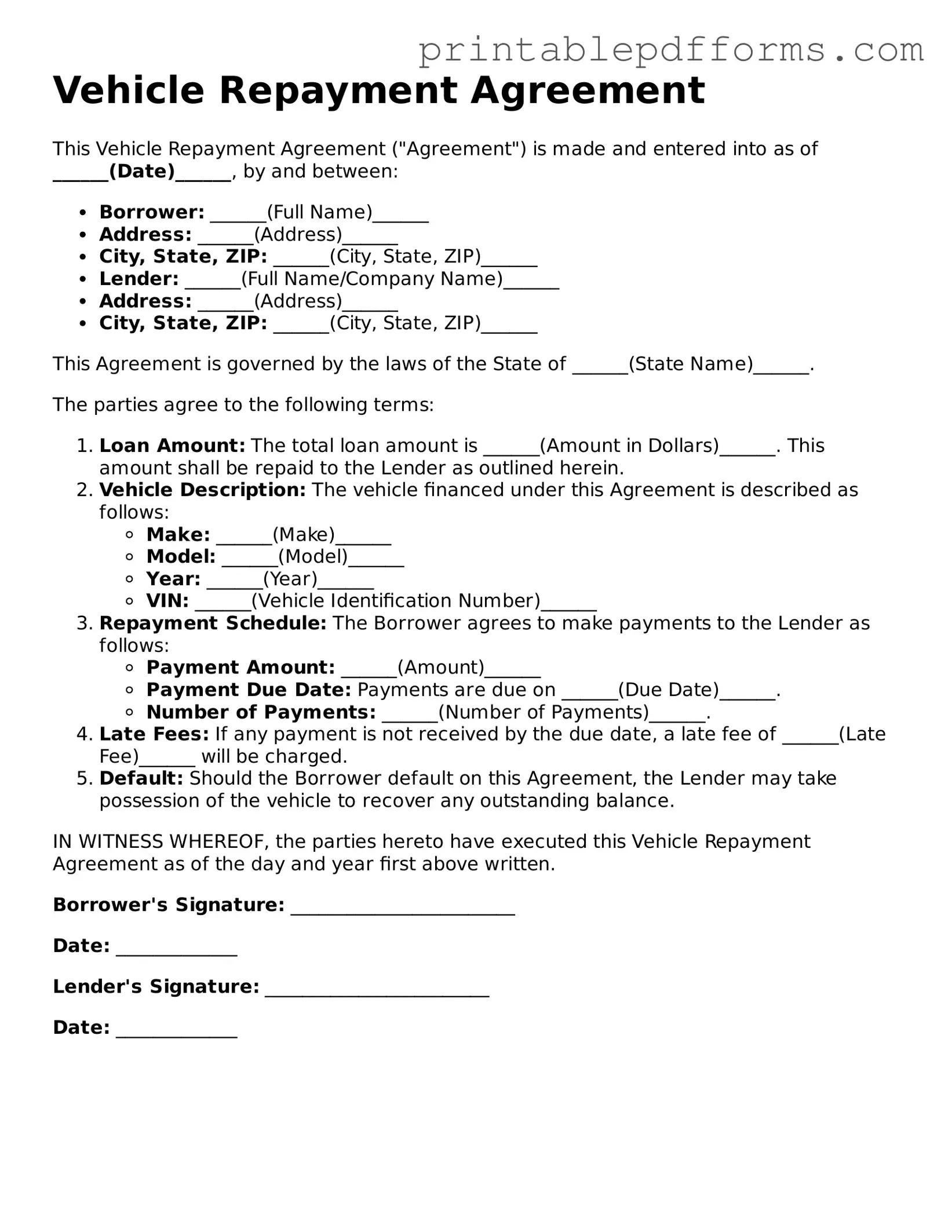

Vehicle Repayment Agreement

This Vehicle Repayment Agreement ("Agreement") is made and entered into as of ______(Date)______, by and between:

- Borrower: ______(Full Name)______

- Address: ______(Address)______

- City, State, ZIP: ______(City, State, ZIP)______

- Lender: ______(Full Name/Company Name)______

- Address: ______(Address)______

- City, State, ZIP: ______(City, State, ZIP)______

This Agreement is governed by the laws of the State of ______(State Name)______.

The parties agree to the following terms:

- Loan Amount: The total loan amount is ______(Amount in Dollars)______. This amount shall be repaid to the Lender as outlined herein.

- Vehicle Description: The vehicle financed under this Agreement is described as follows:

- Make: ______(Make)______

- Model: ______(Model)______

- Year: ______(Year)______

- VIN: ______(Vehicle Identification Number)______

- Repayment Schedule: The Borrower agrees to make payments to the Lender as follows:

- Payment Amount: ______(Amount)______

- Payment Due Date: Payments are due on ______(Due Date)______.

- Number of Payments: ______(Number of Payments)______.

- Late Fees: If any payment is not received by the due date, a late fee of ______(Late Fee)______ will be charged.

- Default: Should the Borrower default on this Agreement, the Lender may take possession of the vehicle to recover any outstanding balance.

IN WITNESS WHEREOF, the parties hereto have executed this Vehicle Repayment Agreement as of the day and year first above written.

Borrower's Signature: ________________________

Date: _____________

Lender's Signature: ________________________

Date: _____________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Vehicle Repayment Agreement form outlines the terms under which a borrower agrees to repay a loan used to purchase a vehicle. |

| Governing Law | This agreement is typically governed by state-specific laws, which can vary. For example, in California, the relevant laws can be found in the California Civil Code. |

| Key Components | Essential elements of the form include loan amount, interest rate, payment schedule, and consequences of default. |

| Importance of Clarity | Clear terms in the Vehicle Repayment Agreement help prevent misunderstandings and provide legal protection for both the lender and borrower. |

Crucial Questions on This Form

What is a Vehicle Repayment Agreement?

A Vehicle Repayment Agreement is a legal document that outlines the terms and conditions under which a borrower agrees to repay a loan used to purchase a vehicle. This agreement serves to protect both the lender and the borrower by clearly stating the obligations of each party.

Who needs to sign the Vehicle Repayment Agreement?

Typically, the borrower and the lender must sign the agreement. If the vehicle is financed through a dealership, the dealership may also need to sign. It's essential for all parties involved in the loan to understand and agree to the terms laid out in the document.

What information is included in the Vehicle Repayment Agreement?

The agreement generally includes:

- The names and addresses of the borrower and lender.

- The details of the vehicle being financed, including make, model, and Vehicle Identification Number (VIN).

- The total loan amount and interest rate.

- The repayment schedule, including due dates and payment amounts.

- Any fees or penalties for late payments.

- Terms regarding default and repossession of the vehicle.

What happens if I miss a payment?

If a payment is missed, the lender may charge a late fee as specified in the agreement. Continued missed payments can lead to serious consequences, such as the lender initiating repossession of the vehicle. It's crucial to communicate with the lender if you're facing financial difficulties.

Can I modify the terms of the Vehicle Repayment Agreement?

Yes, modifications can be made, but they must be agreed upon by both the borrower and the lender. It's important to document any changes in writing to avoid misunderstandings in the future. Both parties should sign the modified agreement.

Is the Vehicle Repayment Agreement legally binding?

Yes, once signed by all parties, the Vehicle Repayment Agreement is a legally binding contract. This means that both the borrower and lender are obligated to adhere to the terms outlined in the document. Failing to do so can result in legal action.

What should I do if I have questions about the agreement?

If you have questions or concerns about the Vehicle Repayment Agreement, it's advisable to reach out to the lender directly for clarification. Additionally, consulting with a legal professional can provide further insights and help ensure that you fully understand your rights and obligations.

How can I ensure I am making my payments on time?

To stay on track with your payments, consider the following tips:

- Set up automatic payments through your bank.

- Keep a calendar or reminder system for due dates.

- Review your budget regularly to ensure you can meet your payment obligations.

- Communicate with your lender if you anticipate any issues.

Documents used along the form

The Vehicle Repayment Agreement form is a crucial document for individuals entering into a repayment plan for a vehicle. However, it is often accompanied by other forms and documents that provide additional context and protection for both parties involved. Below is a list of commonly used documents that complement the Vehicle Repayment Agreement.

- Loan Application Form: This document collects personal and financial information from the borrower. It helps lenders assess the borrower's creditworthiness and ability to repay the loan.

- ATV Bill of Sale Form: When purchasing an ATV, it is essential to complete the nypdfforms.com/atv-bill-of-sale-form/ to ensure proper documentation of ownership transfer and compliance with state regulations.

- Promissory Note: A legally binding document in which the borrower agrees to repay the loan amount under specified terms. It outlines the repayment schedule, interest rate, and consequences of default.

- Title Transfer Document: This document facilitates the transfer of vehicle ownership from the seller to the buyer. It is essential for ensuring that the buyer has legal ownership of the vehicle being financed.

- Insurance Verification Form: This form confirms that the borrower has obtained the necessary insurance coverage for the vehicle. Lenders typically require proof of insurance to protect their investment.

- Default Notice: This document is issued when a borrower fails to make payments as agreed. It outlines the consequences of default and may include options for remedying the situation.

Each of these documents plays a significant role in the vehicle financing process. Together, they help establish clear expectations and provide legal protection for both the lender and the borrower.

Misconceptions

When it comes to the Vehicle Repayment Agreement form, there are several misconceptions that can lead to confusion. Understanding the truth behind these common misunderstandings can help individuals navigate the process more effectively.

- It is only for people with bad credit. Many believe this form is exclusively for individuals with poor credit histories. In reality, anyone who finances a vehicle can use this agreement, regardless of their credit score.

- Signing means you automatically lose your vehicle. Some think that signing the agreement means they will immediately lose their car if they miss a payment. This is not the case; the agreement outlines the terms of repayment and the consequences of default, but losing the vehicle is not an automatic outcome.

- It is a legally binding contract. While the Vehicle Repayment Agreement can be legally binding, its enforceability depends on various factors, including the specific terms and conditions outlined in the document. Always read the fine print.

- Only lenders can initiate changes to the agreement. Many assume that only the lender has the power to modify the terms. In fact, both parties can negotiate changes, provided they agree on the new terms and document them properly.

- It covers all expenses related to the vehicle. Some people think that the agreement includes all costs associated with vehicle ownership, such as insurance and maintenance. However, the Vehicle Repayment Agreement typically focuses solely on the repayment terms.

- Once signed, it cannot be changed. There is a belief that once the form is signed, it cannot be altered. This is incorrect. Changes can be made if both parties consent and document those changes appropriately.

Clearing up these misconceptions can empower individuals to make informed decisions regarding their vehicle financing options.